According to the latest round of weekly checks on downstream channels within the UK solar industry, there is currently a massive opportunity for new EPCs and module suppliers to the UK solar industry, if bandwidth is available and these new companies can get connected quickly with the correct sites and customers.

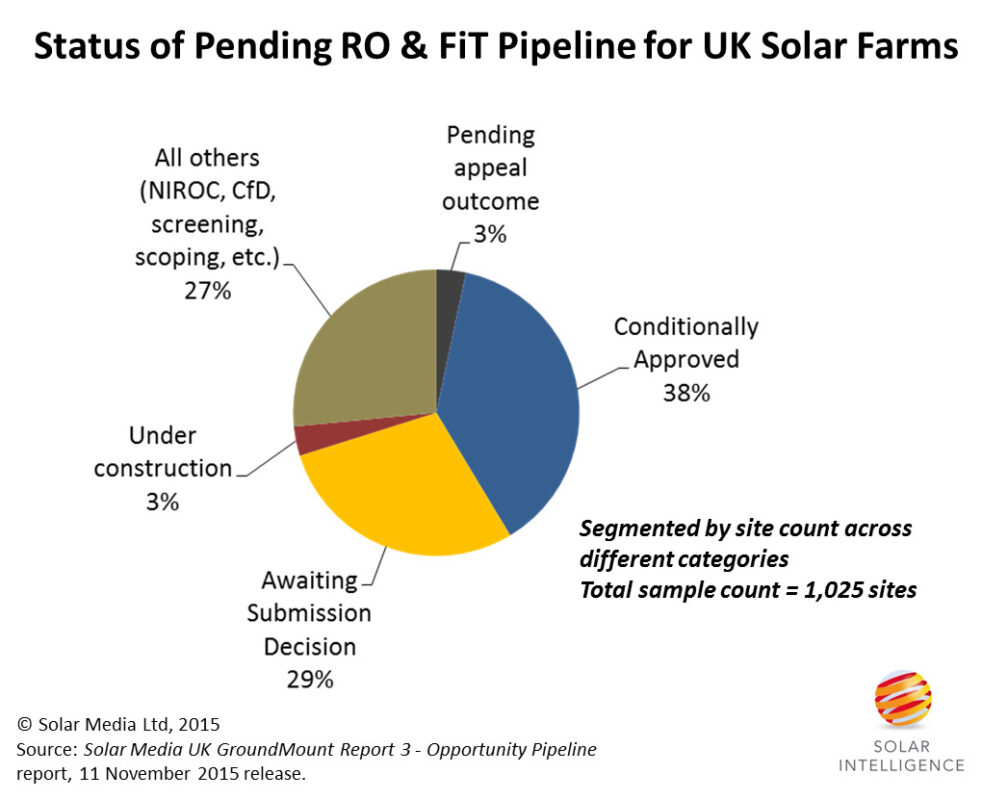

The release of our Report 3 – Opportunity Pipeline database report retains a pipeline of UK solar farms (>250kW) of 1,025 sites. Of this, 753 are seeking RO or FiT accreditation for build out over the next few months.

Looking further at the list of 753 sites, 719 are yet to begin construction, either stuck in planning, awaiting appeal outcomes or trying to get through conditional approval sign-off. Of these 719 sites, 390 are approved adding up to 2.06GW, with 34 awaiting appeal outcome.

However, as much as the numbers stack up favourably if you are looking for large deployment figures being achieved in the near-term, it is now becoming clear to us that there is an immediate lack of supply for developers or asset holders bankrolling potential site completion and subsequent ownership.

In fact, many of the EPCs and module suppliers (and mounting suppliers too) that have been in the UK market for a few years, and have a decent network of customers, have been telling us for some time they are sold out to April 2016. This is true also for most EPCs that made up the bulk of the 2.53GW installed in Q1’15. If established suppliers of modules, inverters or EPC work are not sold out to 31 March 2016, then something is wrong!

Figure Caption: There is now doubt over the completion of up to 300 solar farms in the UK, if EPCs and component suppliers cannot be found in the next few weeks. Source: Solar Media Ltd., Report 3 – Opportunity Pipeline database report.

So, this is either a problem for installation totals over the next four months, or it is a great opportunity for EPCs (the remaining ones with a track-record in mainland Europe that have not been able to get into the UK until now) and module suppliers that again have not had the sales and marketing bandwidth to supply the UK ground-mount market.

It is interesting to view this situation, as we know where the sites are, which developers are behind them, which sites are looking for EPCs, and who are the new developers in the mix where legacy supply arrangements have not been established.

By the time we get to April/May 2016, there are going to be new EPCs to the UK market and new module and mounting suppliers that have been able to react quickly enough and grab the opportunities on offer. Many however will miss the chance, as they are possibly not known outside the UK and will be bypassed as the rush to build and supply intensifies at the start of 2016.

More information on the latest release of the Report 3 – Opportunity Pipeline database report, which tracks all the pipeline sites and progress timelines, can be found here. The report is released every two weeks, with the next edition due out 11 November 2015.