Talk about creating boom and bust cycles! If your goal was to cause uncertainty, impose start/stop work patterns, and create minor panic across an entire sector, it would be a challenge to come up with a strategy more effective than DECC’s handing of the UK solar industry in the past few years.

When DECC effectively signalled its intentions to end the RO scheme to solar one year earlier than originally planned, it also placed a deadline (at least for England and Wales) that planning applications had to be in by 22 July 2015.

This day will long be remembered by the UK solar industry, for years to come. One month late, but for planners the country over that had carved out a comfortable niche in churning out solar applications to LPAs, 22 July 2015 was in effect, solar’s longest day.

If it could be submitted on 22 July 2015, it was. Just what else was the solar industry meant to do? Let’s face it, the RO scheme had been in existence since 2002; then suddenly DECC announces a 24 hour application submission deadline. If you looked up the definition of knee-jerk, it would be hard to get a more fitting description.

The numbers are still being counted by the Solar Media team – there are 400 or so LPAs and validations are still coming through for July applications. Applications went into almost every LPA – many of whom had never seen a solar farm application before.

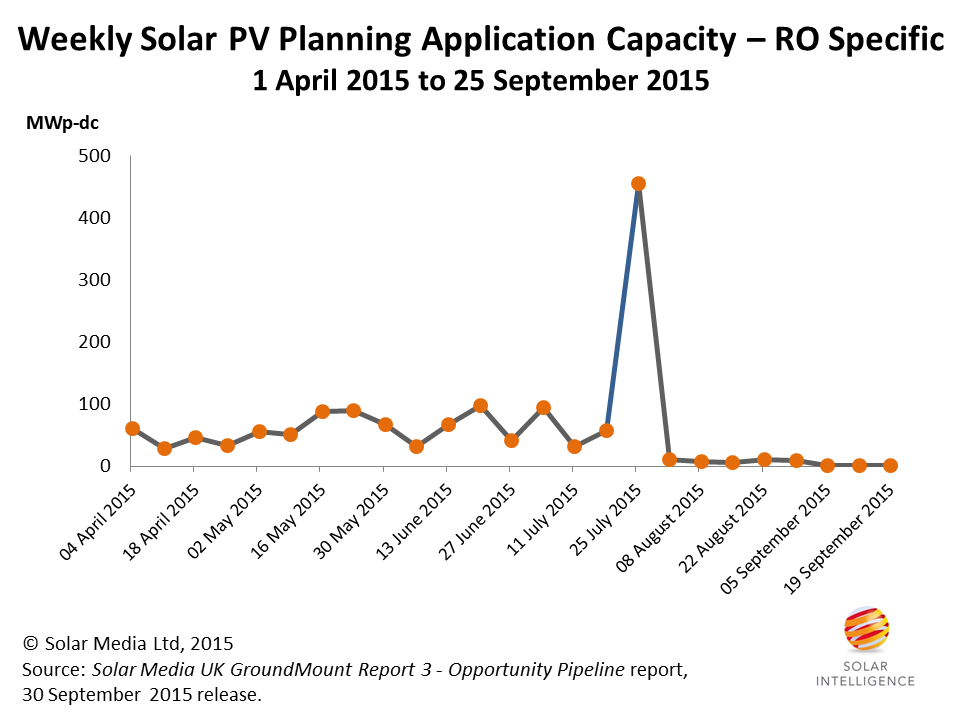

But the picture is certainly emerging. Here is the latest Solar Media Ltd market analysis, where we have plotted weekly MW of capacity of applications submitted for RO scheme consideration, from 1 April 2015 to end of last week (25 September 2015). Understanding the graphic is not difficult.

Figure 1: Solar PV applications submitted on 22 July 2015, the deadline of RO applications for solar, are likely to exceed the 500MW level, once all the counting is done. Source: Solar Media UK GroundMount Report 3 – Opportunity Pipeline report, 30 September 2015 release.

As a reference point, and as if we needed to mention it, DECC is not seeing the above trends. In fact, the latest REPD database, outsourced under a contract to a third party, is showing less than 100MW of solar applications on 22 July 2015 – a factor of 5 less than the real number.

When all is said and done for UK solar ground-mount activity under ROs, DECC’s inability to monitor pipelines and deployment levels in real time may well become its final epitaph, and could go a long way to understanding why policies have often been rushed through in panic mode to control an often rampant solar PV industry.

For now, we are still holding back on forecasting UK solar deployment figures until DECC comes out with the results of the consultation process. In the meantime, we are logging all the applications in our Report 3 database, where we match the original project developers behind all the planning applications.

It is understandable that many in UK’s solar industry are lobbying, commendable that others are bullish on a zero-subsidy climate, and natural that so much disappointment is so evident in many quarters. But life goes on, and in the short-term, while ROs can be grandfathered (assumed to 31 March 2016), then the priority does have to be on site build, supply and ownership.

With so many projects now in the pipeline, knowing where they all are, who is behind them, and the prospects of each being built over the next six months is the only game in town and where the real money is right now.

Whether the bunch-of-fives will cause any long-term damage to DECC is a question purely for the backburner, for now at least.