Oxford Photovoltaics has secured another round of funding to support its IP licensing business model on the back of plans to produce working solar cells for customer evaluations. This follows the recent purchase of the former Bosch Solar CIS thin-film site in Brandenburg an der Havel, Germany.

The latest funding amounts to £8.1 million and follows a recent series C funding of £8.7 million. It was led by Statoil ASA, Legal & General Capital and an unidentified technology-focused, family fund investor.

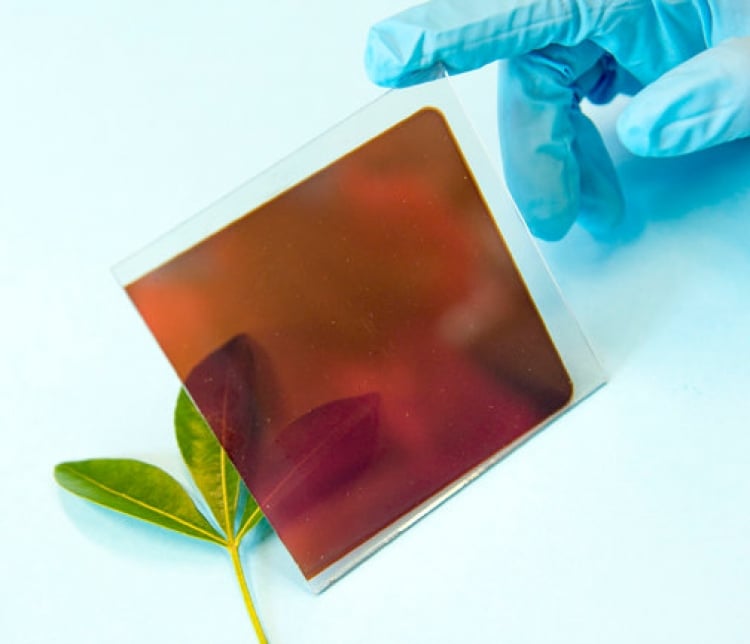

Although the company is not seeking to develop its own perovskite-based PV products, it has to demonstrate commercially ready cells that can be either produced as a tandem layer on top of conventional crystalline solar cells or standalone perovskite cells for thin-film formats.

The business model avoids the need to invest significant amounts of money in volume production equipment and facilities, potentially avoiding the ‘valley of death’ scenario for PV start-ups that tend to fail after burning through raised capital before recouping investments through a successful commercial launch.

However, the IP model does not come without risk as this still requires investment in pilot production equipment and facilities, as well as capital to run extensive sampling for potential customers.

Oxford PV has also recently announced a joint development partnership with an unidentified mainstream c-Si PV manufacturer, critical at this stage ahead of pilot plant sampling operations.

Frank Averdung, chief executive of Oxford PV, said: “In conjunction with our industry Joint Development partner, our perovskite technology now has a clear path and timetable to commercialisation and the formidable support of global market leaders to enable that to happen.”

However, the company has not as yet publically disclosed what the ‘clear path’ and ‘timetable to commercialisation’ is.