All through this week, we are featuring a series of blogs and articles summarising exactly what was deployed in the UK for the three-month period from 1 January 2016 to 31 March 2016.

Ground-mount solar has been dominating the UK in the past few years. The 31 March 2016 deadline represented a hard-stop for large-scale (>5MW) sites, grandfathered from the May 2014 changes to the Renewable Obligation scheme.

This further overlapped with the step-down in ROC incentives from 1.3 to 1.2 ROCs/MWh. Lastly, rooftop FiTs saw strong downward revisions in the quarter, not to mention various deadlines associated with pre-accreditations.

For those that still persist in taking government statistics as the source of UK solar market activity, they are likely to be waiting another six months before the registers from Ofgem get anywhere near what was done in the quarter. (Does nobody learn this is not the way to size a market?)

Today, I will focus on one of the major drivers to solar deployment in Q1 2016; large-scale community-based solar farms. Wednesday will feature the big winners in UK solar during the quarter, and finally on Friday, there will be a comprehensive breakdown and analysis of the quarterly capacity added.

Community-based solar has seen a wide variety of drivers in the past few years, not simply in the UK. Broadly-speaking, community-based solar schemes (whether a single large site on the ground, or a portfolio of smaller sites on rooftops) offer a vehicle in which the public can invest (either up-front or post-build) in solar PV with annual returns based on a range of different factors.

From a UK perspective, investment in a community solar farm is more analogous to a government-backed green corporate bond than, for example, an ISA owing to the source of returns (driven by government based solar incentives) and the longer time periods involved.

Aside however from the mechanics of financial remuneration, community-based solar farms are largely marketed from a community-participation standpoint, and the benefits of shared ownership within a renewable energy site.

In fact, in this regard, community-based participation is not the sole domain of community-assigned schemes. Planning approval for solar farms in the UK generally (unofficially) demands a local community based kickback that is essentially a fixed line outgoing of the returns generated by the asset holder.

Often with the non-community accredited solar farms, this merely becomes a routine rubber stamp exercise between developer and council planners. With the community schemes however, the engagement with the local community moves to an altogether different level, and typically sees a wide range of educational activities complementing the pure financial returns on offer.

In Q1 2016, community-based solar farms truly arrived on the scene within the UK, the reasons for which I will touch upon later in this blog. First up though, let’s look at some of the data to support the commentary.

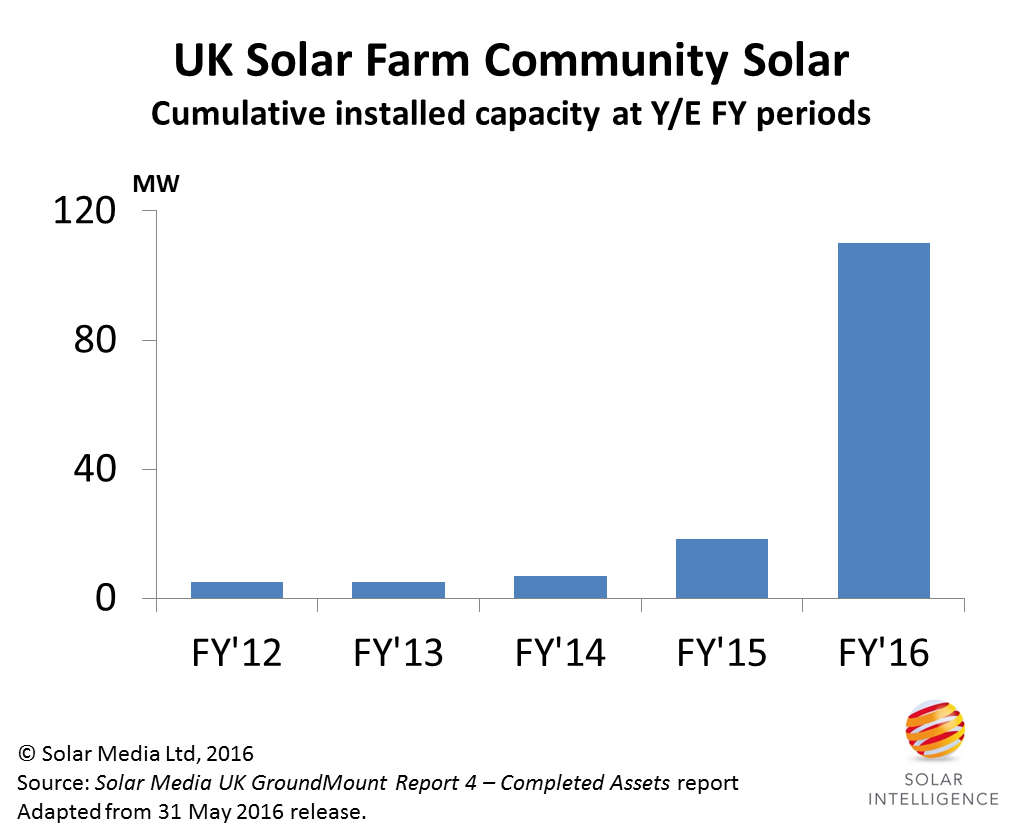

The first graphic here shows the cumulative installed capacity from large-scale solar farms, set up as community-based schemes, at the end of each of the past few UK fiscal year periods (ending 31 March each year). Purely from this graphic, it is clear something changed drastically in the 12 month period ending 31 March 2016.

Figure 1: Community-based solar farms in the UK saw explosive growth in the 12 month period to 31 March 2016, having been more a curiosity addition to the overall deployment numbers in the past. Source: Solar Media UK GroundMount Report 4, May 2016.

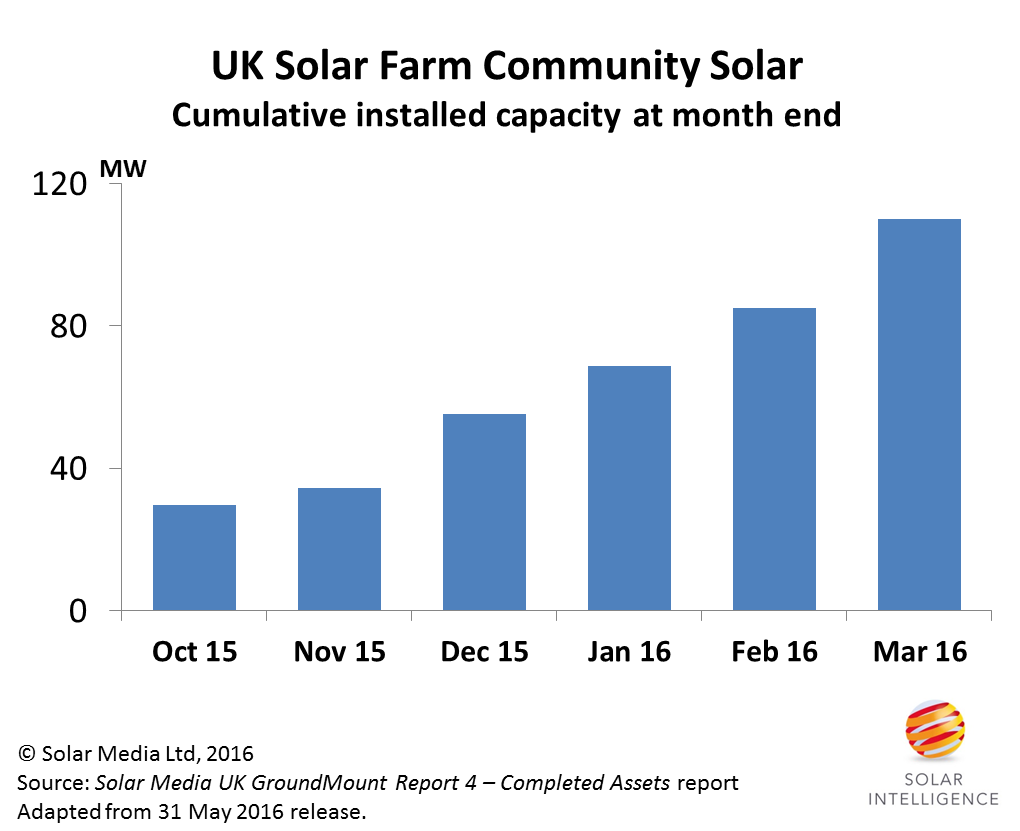

Looking in more detail at the deployment in FY 2016 (12 months to 31 March 2016), we can see that the big push occurred in the final six months, and especially in Q1 2016.

Figure 2: More than 75% of community-based solar farm capacity in the UK, as of 31 March 2016, was installed in the 6 month period from October 2015 to March 2016. Source: Solar Media UK GroundMount Report 4, May 2016.

It is clear that community-based solar farms were a major impact on the overall UK solar deployment data in Q1 2016. But why so much community-based solar farm activity in FY 2016, and why was so much deployed during the first quarter of 2016?

The fundamental arguments for community-based solar farms of recent have been no different to back in 2011 when the Westmill Solar Co-operative set out plans to build the UK’s first community-owned solar farm. Nor do they deviate from the aspirations of German-based developer/EPC Belectric that sought to be an early-mover in this space within the UK through its Big60Million initiative.

Factor in also the undeniable fact that the government (and indeed the mainstream press in the UK) was far more vocal in support of solar in the UK during the period from 2010 to 2013, compared to the onslaught seen during the past 12 months in particular. Community-schemes, like rooftop solar, were typically ring-fenced by politicians as basically a ‘good thing’, in comparison to their dislike of sprawling 200 acre solar farms owned by city-based funds.

It turns out that a few things conspired in the UK during 2015 that effectively opened the door for community-based solar farms, and these were ultimately what drove the strong deployment in FY 2016 and in particular Q1 2016.

Firstly, there is the practical reality of there being other options on the table for solar developers, during the days of 2, 1.6 and 1.4 ROCs, where size was no object and portfolio-owned assets were the most economical routes for solar farms. In short, why try to build a small community-based solar farm that historically took about 2-3 times as long to finally build, compared to a pure-commercial solar site that could be ten times larger. It made no commercial sense, and as a result, the low-hanging fruit of large-scale ROCs consumed the bandwidth (and upfront costs) of solar farm developers and operators in the UK.

The first driver for community solar farms can actually be tracked back to May 2014, when the government changed the ROC rulebook, and put a stop to sites above 5MW in size in the UK. This effectively meant that anything in planning before this only had to 31 March 2015 to get build under 1.4 ROCs (if the developer wanted to build out the full site, normally >5MW in size), or decide (for many reasons) that the site could still be built after 31 March 2015, but under 1.3 ROCs where 5MW was the maximum allowed (unless grandfathering applied from the May 2014 rules).

The reality of the May 2014 changes was that there was a massive amount of approved solar farms potentially left on the scrapheap, where the approved sites were anything up to 50MW in size.

Depending on the size of the approved sites, a number of options were available to developers. A 6MW or 7MW site for example, could probably simply be built out at 4.99MW under 1.3 ROCs (as many were). However, for sites of >10MW in size, the economics of this were not good, nor was that the only option now on the table.

Due to community-based solar schemes being allowed to share grid-connections with commercial based solar sites, the door then opened for 10MW sites to be split into 5+5MW options, so long as one of the sites was a community-based solar scheme. And with this effectively came the rise of community-based solar farms.

Not limited simply to 5+5MW site options, it turns out that developers managed to find ways to ‘rescue’ some sites that were potentially distressed in the absence of any repeat CfD auction process for solar in the UK coming into effect anytime soon. But with so many policy changes, working out exactly what can and cannot be done with site splitting, from a grid-connection and site ownership standpoint, would likely still have ten lawyers arguing things one way or another.

In this respect, ponder this one: how do you split up a 50MW solar site into 9x5MW options? Well, in Q1 2016, this was done in the UK.

Another factor driving community-based FiT schemes has been the pre-accreditation facility that essentially offered a lifeline to sites extending well beyond the 31 March 2016 FY cut-off date. It turns out that a number of sites built from 1 April 2016, and under construction now, are community-based solar schemes that are for all purposes phase 2 builds of legacy ROC-applied schemes that missed the 1.4 ROC build cut-off on 31 March 2015.

One can of course choose to be romantic and presume that the UK happened to have a remarkable outpouring of altruism and COP-21 stimulated climate-change awareness that led to a deluge of community-based solar farms being built in the six months from October 2015 to March 2016. No harm in this.

But the reality is that solar farms, commercial or community, don’t happen quickly (and anything solar in the UK has to happen quickly or the government will change the goalposts) without skilled and opportunistic developers and community-based vehicles being established to engage the public in a professional and upfront manner. And here, the UK truly excelled in this regard during Q1 2016 and this continues to be seen now as community-based schemes still being built and funds secured.

Wherever you sit on the fence, in terms of the ‘why’ question, the reality will be that the UK will have more than 150MW of community-based solar farms in operation by the end of the year. And watch this space, sometime in the future, a government minister will more than likely stand up and say this was all part of a successful government strategy and policy to have the public actively investing in the future security of renewable energy supply in the UK. Perhaps, cynicism aside, there will also be no real harm done through this either.

Next up on our weekly special on sizing the UK solar market in Q1 2016 will a blog on Wednesday, where I state which companies were the big winners during the quarter, all ahead of the full deployment data being revealed at the end of this week.