Foresight Solar Fund’s annual report gave an intriguing insight into the operations of a major asset owner, detailing how power prices, unexpected grid downtime and Brexit have impacted on its day-to-day running this year. But perhaps the most interesting detail is that of the continued problems with sites it purchased from SunEdison. Also this week, Transport for London revealed to Solar Power Portal that it is preparing to launch a tender to develop solar on its estate, and both BlackRock and PIP make secondary market plays.

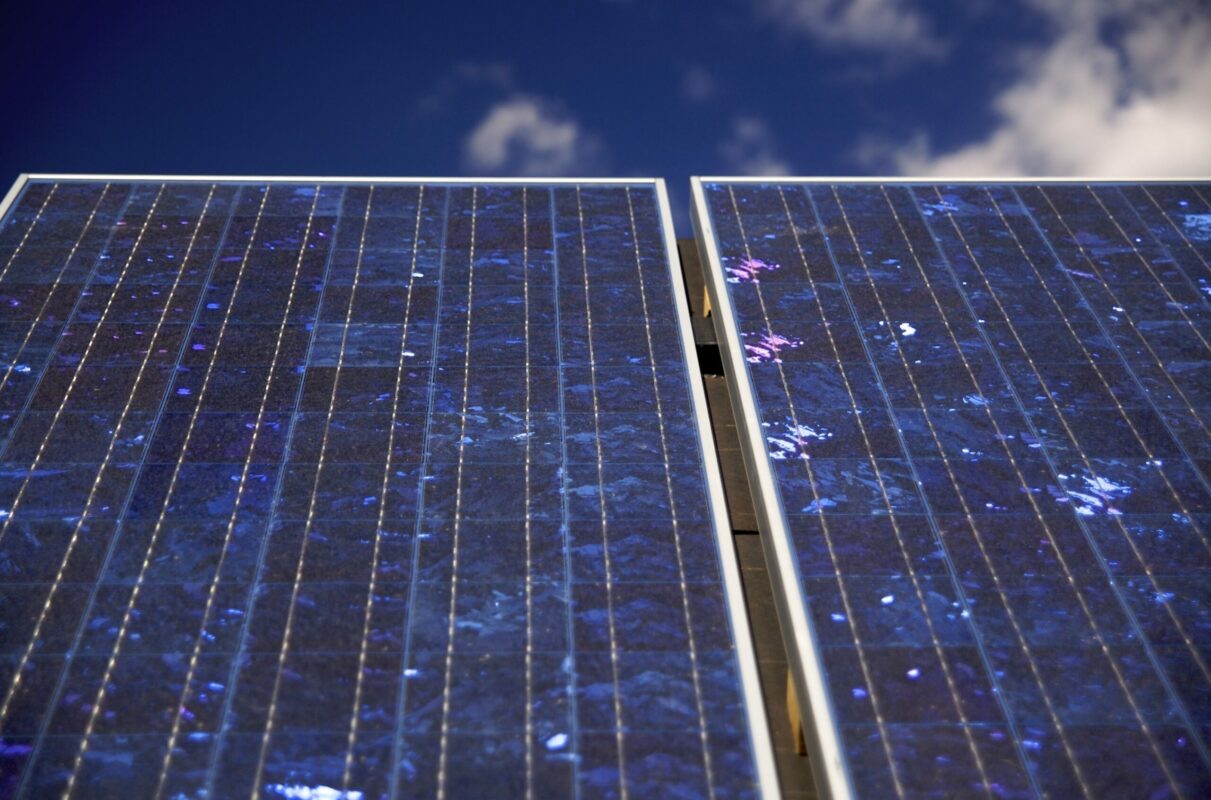

Foresight’s problems with SunEdison-built assets persist as owner shrugs off underperformance

Foresight Solar Fund has continued to experience serious underperformance issues with SunEdison-built assets that it owns a year after the problems were first made public.

TfL prepares to launch tendering process for new solar

Transport for London (TfL) is preparing the imminent launch of a tendering process for new solar installations on its own buildings, Solar Power Portal understands.

BlackRock adds to solar portfolio with ib vogt deal

A BlackRock Real Assets-managed fund has acquired two operational solar farms from prolific German EPC ib vogt.

Cuts to subsidy and funding leaves over 70% of councils without a solar strategy

Over 70% of local authorities across the UK have no strategy in place to invest in solar, with almost half pointing to a lack of incentives from government as the main barrier to deploying council solar, according to a survey carried out by LG Solar.

Pensions investor makes first play into UK ground-mount solar

Pensions Infrastructure Platform (PiP) has reached an agreement with Trina Solar to acquire a portfolio of six UK solar sites with a combined capacity of 30MW following the successful conclusion of each farm’s construction phase.