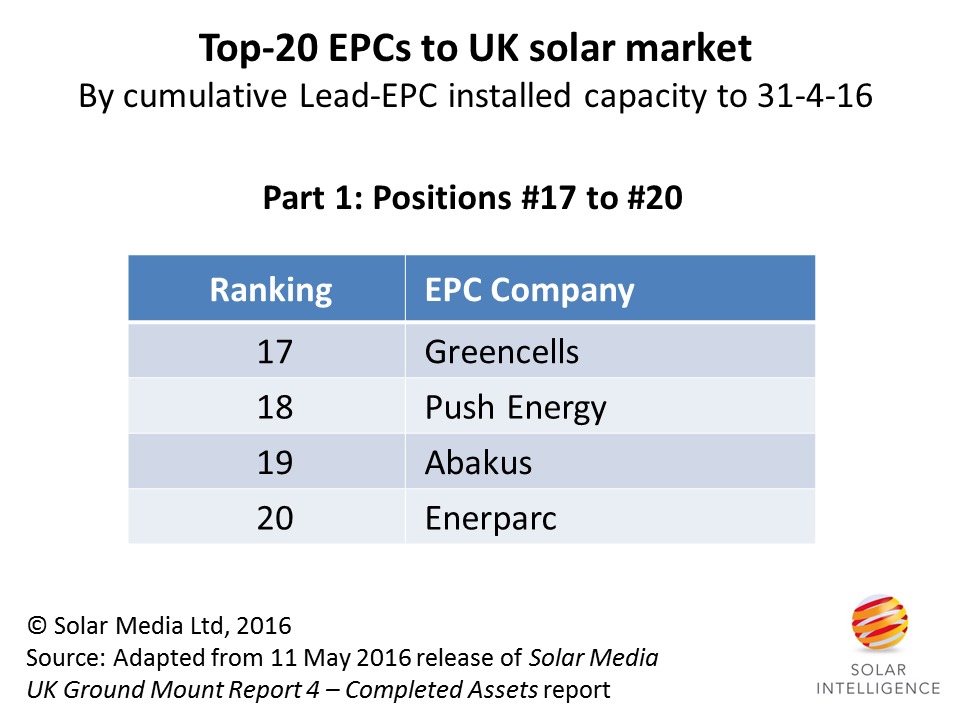

Today marks the start of our Top-20 EPC week on Solar Power Portal, as we count down the leading companies having installed solar PV capacity in the UK during the past six years. The first part covers companies holding the ranking positions from 20 down to 17.

The split out of the top 20 companies is approximately split into four groups, with the specific breakout also following installed capacity thresholds. Instead of simply splitting the top 20 into four equal brackets of five companies, we have applied some flexibility, if there are some clear differences in the installed capacity levels for the different companies.

As an introduction to the ranking exercise, the first thing to note is that entrance to the Top-20 EPC list demands a cumulative total of at least 100MW as Lead EPC for completed sites, at the cut-off date used in the analysis here, at end April 2016.

While various companies have been involved in sub-contracting activities for well above the 100MW figure, they are only included if they have been the lead EPC for the builds. Otherwise, the Lead EPC holds the installed site capacity under their totals. This also eliminates any double-counting; however, it should be noted that the methodology we use completely removes double-counting, as everything is derived bottom-up at the completed site level. This also avoids any vague marketing announcements from companies that often confuse market observers that do not have a complete database of sites in the first instance.

As a final aside, before we look at the first group of EPCs, simply having 100MW of installed EPC capacity in the UK is not in itself a prerequisite for inclusion in the Top 20, with several companies outside of the Top 20 list having accumulated >100MW Lead EPC totals, but do not have high enough capacity levels to get into the league table.

The first grouping covers companies in positions #17 to #20, shown below.

Traditional European EPCs, flexible EPC/sub-contractors and UK-specific developer/EPC companies make up the profiles of companies featuring in positions 17-20 for build solar capacity in the UK.

The most interesting thing about our first subset of Top 20 EPCs is the scope of the activities covered by each of Greencells, Push Energy, Abakus and Enerparc. And in many respects, this sets the scene for much of the commentary that will unfold over the coming days as we reveal the full list of 20 companies in the UK solar league table.

20: Enerparc

Occupying the final position in our Top 20 EPC list is Enerparc. The company is the first of many German engineering firms that has benefited from the UK ground-mounted sector in the past few years. As we run through the analysis this week and add our commentary on the relevance of the companies included, the broad scope of activities by German companies will become clearer.

Enerparc’s activity in the UK has been more traditional in nature as a stand-alone Lead EPC, with post-build O&M activities making up the only other major addition to UK based operations. As a company, this tends to overlap with non-UK business, which is heavily weighted still to solar farm builds in its domestic German market.

Lead-EPC activity in the UK has been largely concentrated to 2014, 2015 and the first quarter of 2016, with a mix of small, mid-range and large solar farms built.

19: Abakus

Another long-time German solar EPC, Akakus is placed at number 19, and indeed, activity from Akakus in the UK is not entirely unlike Enerparc above, with a few differences.

In the UK, Abakus has been responsible for a number of solar farm EPC works but most closely aligned to the activities of a single developer – something that left the company rather exposed as the landscape of developers changed rapidly about two years ago.

The UK operations sought to grow business also through joint venture activity, but overall capacity installed in the last 12 months has been well below many of the other EPCs featuring in our expanded EPC grouping that also includes companies outside of the Top 20.

In April 2016, the German parent company of Abakus UK filed for preliminary insolvency proceedings.

18: Push Energy

The first inclusion in the Top 20 league table from a true UK-based solar EPC operation, Push Energy comes in at position number 18.

Push Energy represents a somewhat special case as a company that, having entered the market at the end of 2012, set out a focused strategy concentrating on developing sites mostly in the east of England and keeping hold of projects during the in-house EPC build process. During the fiscal year under 1.4ROCs, the average size of sites built by Push Energy was an impressive 15MW, well above the average in the industry at the time.

The company remains one to watch in a post subsidy environment.

17: Greencells

Coming in at number 17 is Germany-based Greencells. While this company offers a broad range of services across the full upstream/downstream stages of solar farm creation, and addresses multiple end-markets, its activities in the UK have been more concentrated since they entered the UK at the end of 2014.

Starting as mainly a sub-contractor for other European EPCs doing solar farm builds in the UK, Greencells had a more flexible and pro-active approach, in comparison to other mainland Europe sub-contractors that largely did work on a reactive basis and often to only one EPC customer. As such, Greencells juggled its time between EPC sub-contractor and full Lead EPC roles. Over the past 12 months, the balance has shifted more to the latter, with the reset to 5MW ROC sites providing more opportunities compared to the market under 1.4ROCs that had fewer, but much larger, sites for EPCs to compete for.

Greencells inclusion in the Top 20 list, and the model applied to UK solar in particular, is indicative of several other European contractors that have been able to make the transition from sub-contract to full Lead-EPC role, as the market became awash with 5MW sites following the cut-off for 1.4 ROC qualification on 1 April 2015. Often with more streamlined operations compared to other buildings or infrastructure based companies (within which sits the solar EPC business unit), these companies have been well positioned to benefit from the UK solar market in 2015, and indeed continue to see strong opportunities in 2016.

Being unburdened by not participating in site development or initial build or asset-holding costs also keeps the focus on getting the site built with minimal overheads, or indeed distractions. While some people assume that in-house build capability should give the lowest overall costs, it has been shown time and again that solar farm building (quickly and efficiently) is an art form of sorts. Furthermore, what do you do with your engineering team during periods where nothing is being built, or if you have to alter your business model? More on this theme during the next few days as we continue our countdown.

The Top 20 EPC list continues tomorrow, with companies holding the ranking positions from 12 to 16 revealed and discussed.

All data used in the Top-20 EPC methodology is contained within our Solar Media UK Ground-Mount Report 4 – Completed Assets report that includes a full audit trail of completed solar farms in the UK, with updated releases delivered to subscribers each month.