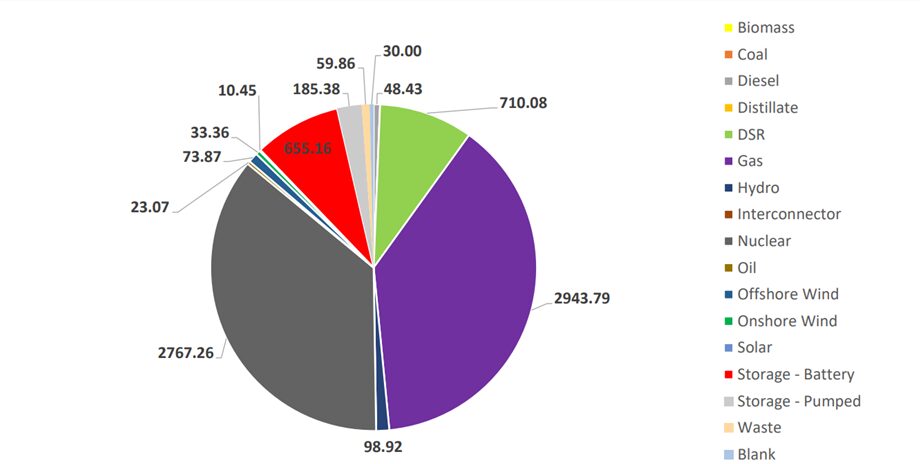

Battery energy storage systems (BESS) were awarded 655.16MW in the T-1 Capacity Market Auction for delivery year 2024/25, which cleared yesterday (20 February) after eight rounds at £35.79/kW/year.

According to the National Grid ESO’s preliminary results, this was the highest capacity awarded to clean technologies in this auction round, followed by pumped storage which received 185.38MW (2.43%). As well as this, solar was awarded 10.45MW (0.14%), hydro 98.92MW (1.29%), and offshore and onshore wind received 73.87MW (0.97%) and 33.36MW (0.44%), respectively.

Capacity Awarded by Primary Fuel Type (MW)

The majority of capacity was awarded to gas as a primary fuel type 2,943.79MW (38.53%), closely followed by nuclear 2767.26MW (36.22%) Demand-Side Response (DSR) was then awarded the third largest volume of capacity at 710.08MW (9.29%).

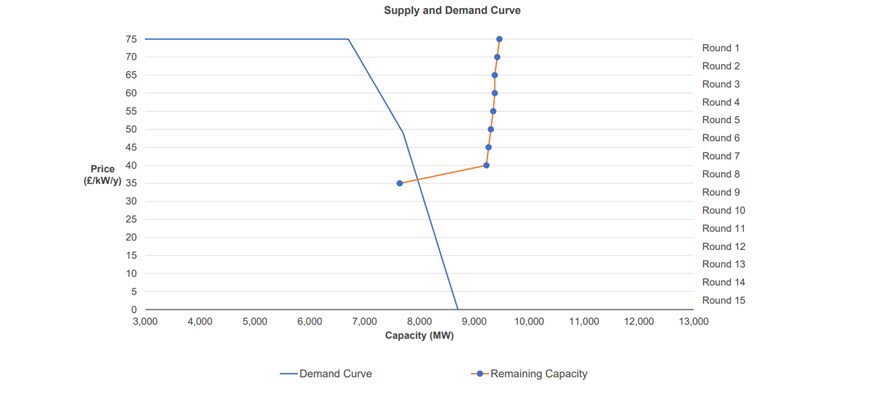

The provisional results show that roughly 9.5GW of de-rated capacity entered this year’s auction with less than 300MW exiting in the first seven rounds.

Jake Thompson, data scientist at energy data analyst’s Montel EnAppSys pointed out that the c.819MW Sutton Bridge and c.850MW Severn power stations (the two largest units in the auction) both exited in the eighth round, removing their collective c.1.5GW of capacity from the auction and causing it to clear. This meant that the 7.6GW of capacity was awarded across a total of 277 capacity market units (CMUs)

The Capacity Market’s growing role in BESS revenue stacks

Georgina Morris, head of capacity market policy – low carbon technologies for the Department of Energy Security and Net Zero (DESNZ), confirmed that the T-1 auction 2024/25 has cleared at £35.79/kW/year (40% less than the £60/kW/year cleared in the 2023/24 auction) on the second day of Solar Media’s Energy Storage Summit 2024.

Using the example of a 30MW two-hour BESS system, Morris explained that this clearing price would set revenues for that asset owner at around £240,000 over the course of the delivery year “and that’s noting the 22% de-rating factor for two-hour systems,” added Morris.

Explaining what she believed these results mean for the UK BESS sector, Morris said: “What I’m seeing from various commentators is that the Capacity Market is starting to become a more important part of the [BESS] revenue stack.”

Morris cited a recent report by Modo Energy which found that over 2023 the average battery income was £51,000/MW/year across the wholesale market, ancillary markets and Balancing Mechanism; this increased to £65,000/MW/year when assets included Capacity Market income.

“The Capacity Market is not the main chunk of the [BESS] revenues stack,” continued Morris, “but I am starting to think that, especially in a high-interest environment, guaranteed contractual payment is important for batteries.”

The T-4 auction for delivery year 2027/28 will take place next week.

Part of this article was taken from our sister site Current± which can be found here.