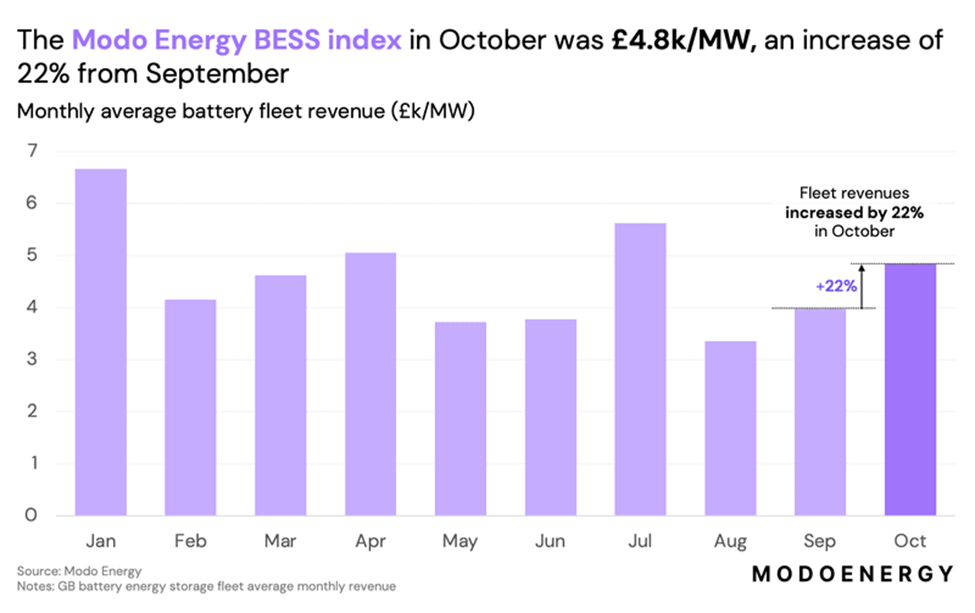

Battery energy storage revenues rose by 22% from September to October to £4.8k/MW, Modo Energy has revealed.

This rise follows battery revenues increasing by 19% from August to September.

New research by the asset platform showed that average revenue for batteries under 1.5 hours and over 2.5 hours in duration stood at £4.3k/MW and £6.2k/MW respectively.

Equivalent to £57k/MW/year, the 22% increase saw October deliver the fourth-highest revenues this year so far, added market lead analyst at Modo, Wendel Hortop.

Following a dip in August, these figures show a welcome increase in battery storage revenues following the impressive 53% increase seen between June and July.

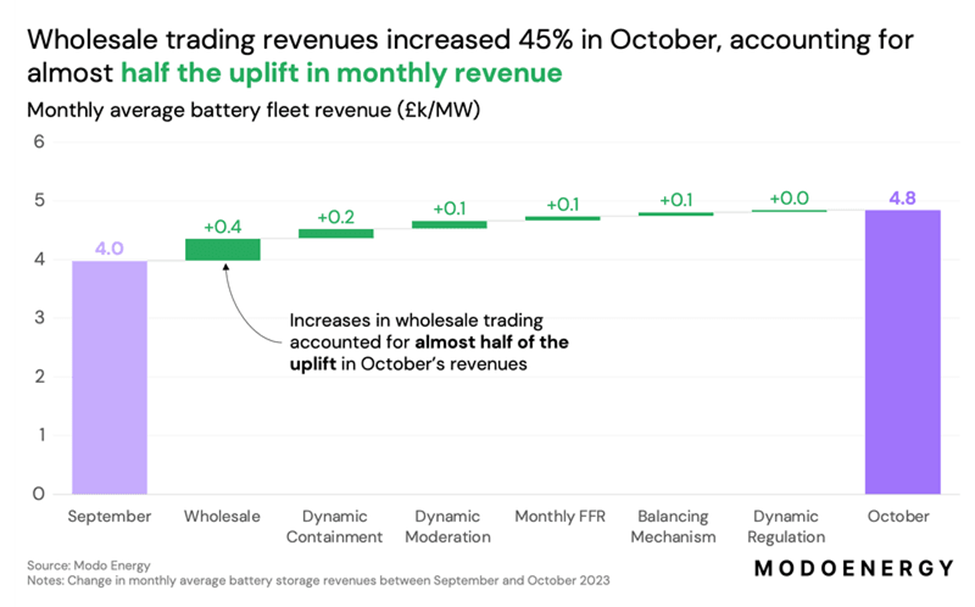

Modo Energy attributed the majority of this increase to wholesale trading revenues rising by 45% from September to October this year, reaching their highest level since December 2022 and contributing 9.4% of the increase in battery revenue from September to October.

The increase in trading revenues followed a 32% rise in trading spreads to £100/MWh on average which, Hortop said, was mostly driven by sustained high wind generation in October. This is the second consecutive increase of 32%.

Gas prices also rose by 17% month-on-month in October, contributing to the rise in trading spreads.

A blustery October drives improved price spreads

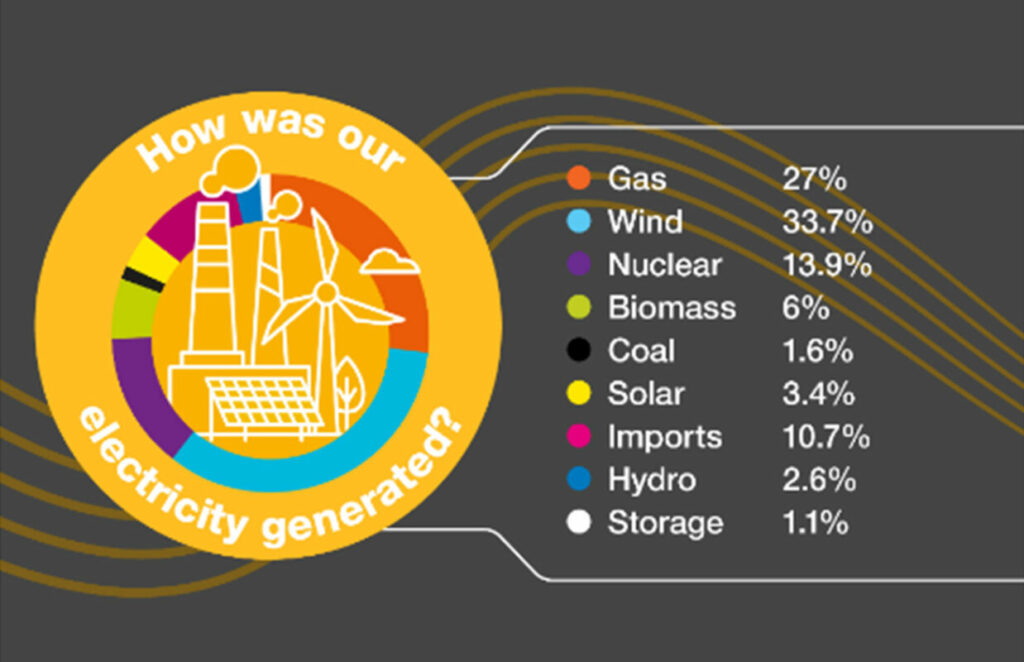

National Grid ESO’s monthly electricity stats showed that wind was the largest contributor to Britain’s electricity mix in October at 33.7%, followed by gas at 27%.

Wind generation across October averaged 10.3GW, said Hortop, representing a 40% increase from September and the highest level of wind generation since February.

There were 14 separate occasions which saw high wind generation during periods of lower demand which caused prices to fall “significantly”, according to Modo research, double the amount seen in September. These drops increased price spreads during October, averaging at £123/MWh during the aforementioned 14 days, compared to £82/MWh on ‘regular’ days.

Dynamic Containment and Dynamic Moderation prices continue increasing

Modo Energy, attributed 7.8% of the October battery revenue increase to climbing Dynamic Containment and Dynamic Moderations prices.

Following a record low Dynamic Containment prices in August, which saw Dynamic Containment Low averaging at £1.49/MWh and Dynamic Containment High averaging at £2.9/MWh, prices have experienced an increase for their second consecutive month.

Wholesale trading value during October helped increase the Dynamic Containment price by 20%, said Hortop, whilst Dynamic Moderation prices increased by 60% “as a result of a fundamental shift in how ESO views the service.”

Here Hortop refers to National Grid ESO’s monthly ‘Frequency Response Market Information Report’ from September, in which the ESO it will increase Dynamic Moderation requirements as well as set price caps for the service.

The 60% increase saw Dynamic Moderation prices hit their highest level since November 2022.

Will battery revenue’s continue increasing into November?

According to Hortop, the launch of the Enduring Auction Capability on 2 November, which will see participants able to bid into and deliver multiple frequency response services simultaneously, as well as splitting assets across services and submitting negative bids.

Although improving the efficiency of procuring frequency responses for the ESO, the new structure is expected to lead to lower clearing prices, whilst the ability to bid at negative prices will pull down prices even further.

“If this pricing trend continues, operators will be left hoping for further increases in trading revenue to offset dips from frequency response services,” concluded Hortop.

LCP Delta, released a report at the beginning of September, warning of the risk of an over-reliance on frequency response markets as they will no longer achieve the high returns historically available for battery assets.

Instead, the energy analytics and consultancy firm suggested more “sophisticated” strategies for battery energy storage assets to build revenue such as revenue stacking from wholesale and the balancing market as more lucrative options for battery storage investors, or else riskier options such as Net Imbalance Volume chasing.

This story was first published on our sister site Current±, the original story can be found here.

Solar Power Portal’s publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 21-22 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.