UPDATE: Shortly after this blog was published, the deadline for applications for the Renewable Electricity Support Scheme was pushed back until 30 April 2020 in light of the ongoing COVID-19 outbreak. The text below has been amended to reflect the new date.

Applications for the long-awaited Renewable Electricity Support Scheme (RESS) opened in the Republic of Ireland on 9 March 2020 and will be open until 30 April 2020.

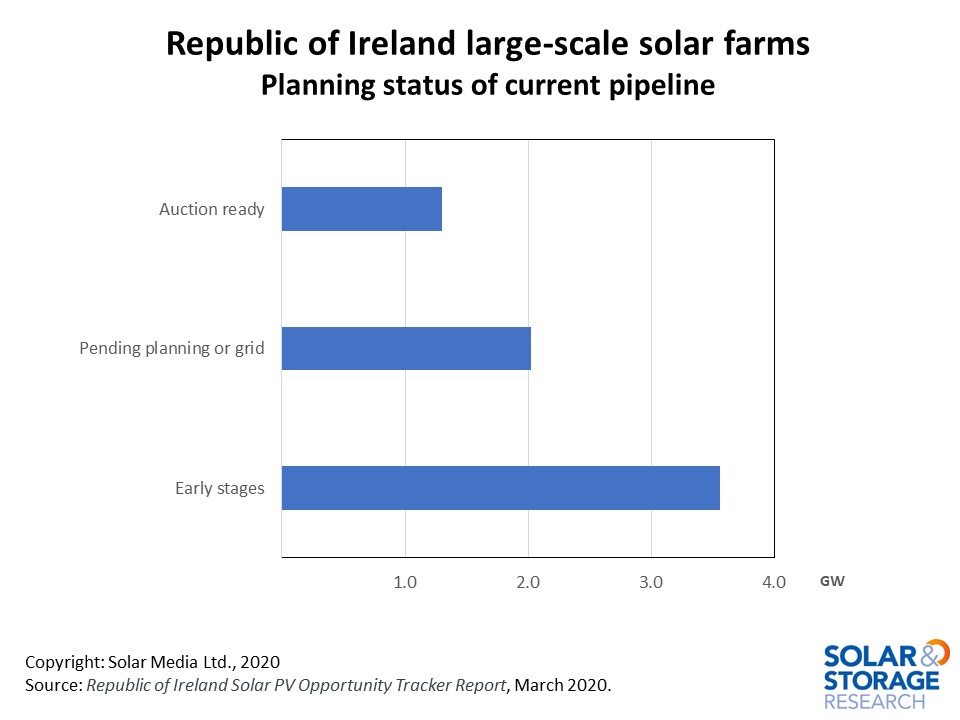

The total pipeline of projects in the Republic of Ireland has now reached nearly 6.9GW and, after years of uncertainty, there are approximately 1.3GW of projects eligible to participate in the first round auction. The successful projects will then be part of the first phase of ground-mounted solar construction in the Republic of Ireland.

This article discusses projects that make up this pipeline and the opportunity for solar deployment in Ireland in the coming years. The data presented is taken from the March edition of the Republic of Ireland Solar PV Opportunity Tracker Report. Details on how to access the report can be found through the link here.

Our in-house market research team has been tracking the Irish solar PV market since 2016 when the initial subsidy announcements were made. Throughout 2015 and 2016, planning and grid applications were submitted for solar farms and the pipeline of projects began to grow rapidly.

We saw lots of familiar names from the UK solar industry entering the market, and also wind developers with experience of developing projects in Ireland in addition, other Irish companies who saw solar as an opportunity started to submit projects.

However, four years on and we are just seeing the beginning of the RESS and it is thought that construction will begin on successful projects in later 2020 or early 2021.

In the initial phase of applications, the first step was to submit a grid application; delays with processing applications meant that queues formed for the busiest substations. The anticipation of the potential subsidy meant that many speculative applications were submitted that didn’t go on to a full planning application.

In an effort to reduce queues and spread grid upgrade costs, ESB introduced the Enduring Connection Policy (ECP) which aims to process applications in batches in order to plan the capacity better. Projects applying for a grid connection under the ECP must have planning permission in order to reduce the number of speculative projects.

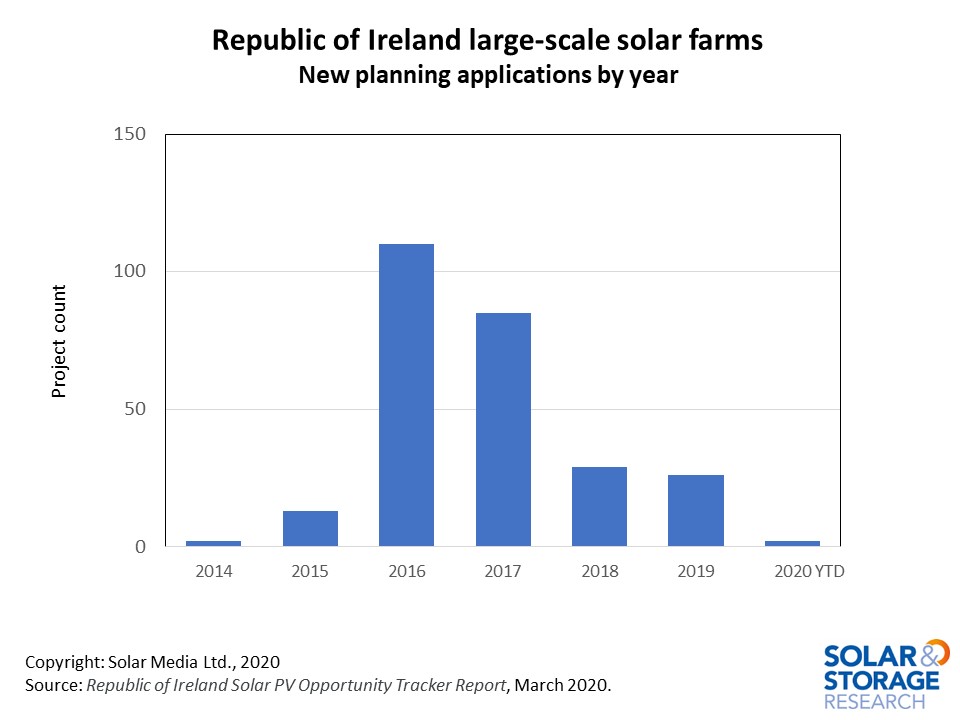

Initially it was assumed that projects participating in the RESS would need both planning permission and a grid connection contract, this was confirmed in the RESS terms and conditions. The chart below shows planning applications by year; we can see a large number being submitted in 2016 and 2017, dropping significantly in 2018 and 2019.

We estimate there are approximately 1.3GW of solar projects that would be eligible to participate in the first round of the auction. This includes projects which obtained planning permission and a grid-connection contract under the previous system. It also includes projects which are being processed under the ECP which have been given an issue date in Q2 2020 and are able to provide documentation from ESB that shows they are due to be issued a grid connection.

There are currently 36 companies with auction ready projects, and we have already seen companies entering the market looking for advanced stage projects to develop. It is likely this will continue in the coming months.

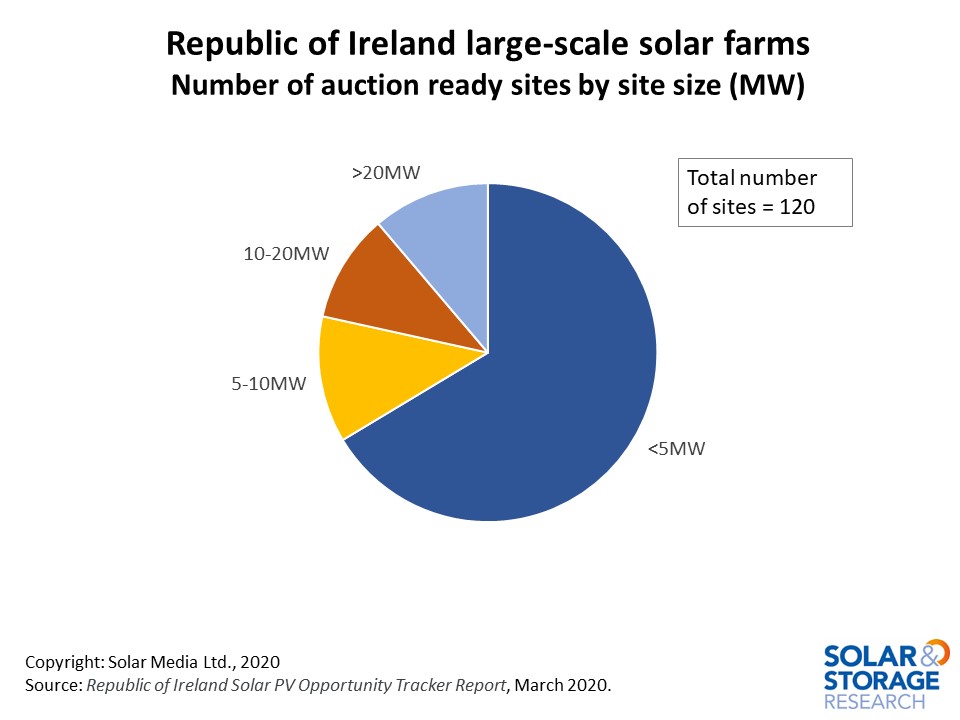

We know from the RESS documents that there will be a carve-out for solar with a maximum of 300GWh – equivalent to around 300MW – in the first auction. With this in mind, we can look at the sizes of the projects that are eligible to participate in the auction. We can see in the chart below that around two-thirds of the project are below 5MW.

However, the remaining segment is made up of larger projects and 10% of projects are in excess of 20MW. With the largest project at 100MW (and several projects in the 80MW-100MW range) it shows how competitive the auction could be for solar projects aiming for the 300MW in the carve-out. Any projects that aren’t successful in the solar carve-out will be included in the general auction but they will be competing against onshore wind.

Companies looking for opportunities in Ireland should be keeping a close eye on the outcome of the auction. Successful projects will be aiming to begin construction within the next 6 to 12 months and will need to make decisions on construction and components over the coming months.

The Republic of Ireland Solar PV Opportunity Tracker Report is updated monthly and includes details of all the auction ready solar PV projects in addition to a further 650 projects at various stages of development. For more details on how to access this site-specific report, please contact us here.