The 6MW/10MWh battery in Leighton Buzzard, the first of its size in the UK, was developed in late 2014 as a demonstration project. It will now support local winter peak demand and provide services to National Grid. Image: UKPN.

With the UK’s Renewables Obligation (RO) now closed for large solar projects, energy storage takes the position of the most active sector in the UK energy market. As with any new technology, we have seen a lot of build up over the past few years, with much speculation about when the utility-scale market will take off, and how big it will be.

Although we still can’t be sure which applications and business models will prove the most successful, we can be sure that activity is building and 2017 is likely to be one of the busiest years yet for grid-connected energy storage in the UK. In 2016 we saw over 70 planning applications for new projects being submitted to local councils.

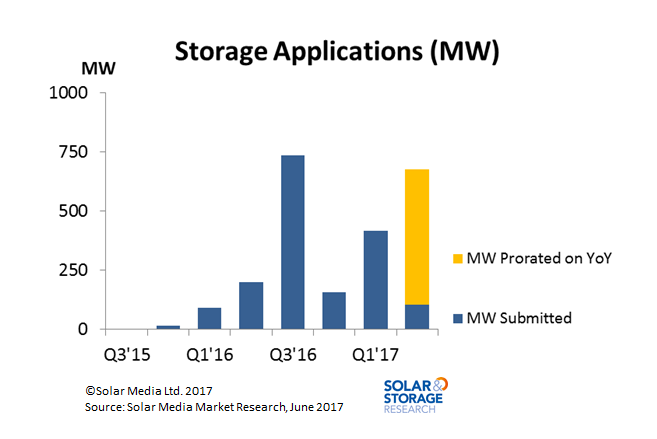

Figure 1 shows how this number of energy storage applications compares to previous years and we can see that there was a significant jump in applications in 2016. In particular an increase can be seen in Q3 in advance of the EFR (enhanced frequency response) auction in Augustand the Capacity Market T-4 Auction in November

So far in 2017, applications are up year-on-year compared to 2016, with over 400MW of applications submitted in Q1. Further capacity market auctions are expected later in 2017 and National Grid will continue to procure frequency services, meaning we will likely continue to see clusters of planning applications as information becomes available on timelines.

Comparisons have been made between the development of large-scale energy storage in the UK and solar farms. There are strong links between the two sectors, including companies already active in both and the benefits that storage can provide existing solar farms. However, the main difference is that solar was a subsidy driven market, whereas energy storage is market driven.

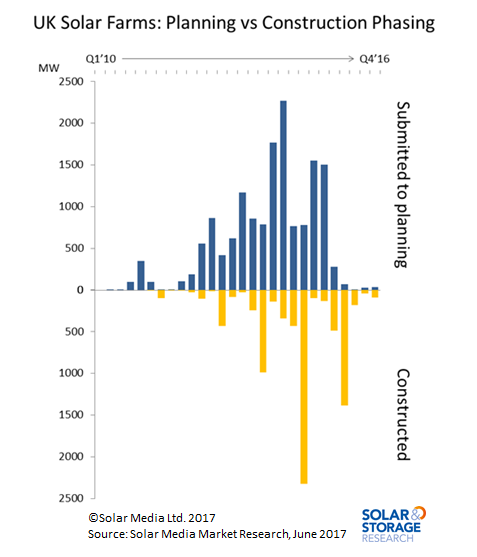

Solar Media market research has been able to apply a similar methodology used to track the development of solar to track the energy storage market. A major source of data and key indicator of the market trends is planning data. Like solar farms, utility-scale battery storage needs planning permission, and tracking planning applications allows us to develop a good picture of the pipeline. To illustrate how this data can be used, figure 2 shows the timing of solar farm applications compared to the build-out rate.

Figure 2

It can be seen immediately that the number of applications made is much higher than the built projects and this is something that we are likely to see in energy storage as business models develop. Figure 2 also shows the time lag from application to build and we expect a similar trend for energy storage which indicates that we will begin to see the construction of energy storage systems with applications made last year. This is something that is already being seen in the market, with a number of energy storage systems currently under construction.

So far with over 1.8GW of projects in the planning system and over 60% of these approved, grid-level energy storage in the UK is moving quickly. It is not seeing the same barriers in terms of planning applications and is generally being seen as a positive development in the energy market. The real challenge will be in developing financial models that will allow investment in this sector. This is the area where we will see the most innovation and change in 2017 and will be the deciding factor in how much storage we will see completed this year.

Join Lauren Cook and Finlay Colville of Solar Media's market research team in the free webinar: “UK Solar & Storage Market Update” on Wednesday, 21 June at 11:00am BST (12pm CET). Register here.

For more information about proposed and operational storage projects, the UK Battery Storage Project Database report from Solar Media market research provides comprehensive details across more than 200 battery storage projects. For more information, click here, or email: [email protected].