Image: Getty.

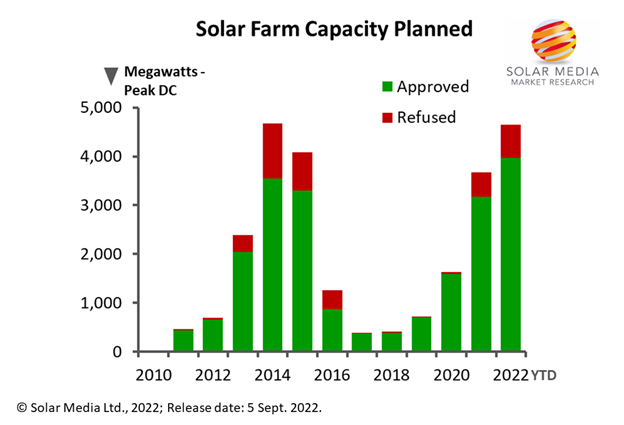

A record level of solar farm capacity has been approved in the UK during 2022, with just eight months completed. And a significant level of submitted capacity is likely to be added to this record figure before the end of the year.

This article reveals – for the first time – how much solar farm capacity is being approved in the UK these days, compared to how much is getting refused by planning authorities.

The analysis – undertaken directly by the in-house Solar Media Market Research team – shows that almost 4GW of new solar farm capacity has been approved in the first eight months of 2022, up from 3.1GW that was approved during 2021.

Pointing towards a strong level of annual deployment over the next five years, the UK Solar Summit – taking place in London on 14-15 September 2022 – will hear from key players in the sector that will drive much of this new build activity going forward.

Topical and debated in the mainstream media

Solar farms are being discussed widely today in the UK, and this is not a surprise.

There are several factors in play here; the large number of applications that have been in the works for the past couple of years, the scale of some of the sites (especially Nationally Significant Infrastructure Projects (NSIPs)) that are much larger than in the past, some of the clusters of applications being proposed that are concentrated in certain regions in the Midlands and Eastern parts of England, the ongoing role of solar within the UK’s overall energy mix and the somewhat politicised issue of food versus energy production on land in general.

It does lead to a rather confusing picture. Not helping anyone also has been some rather spin-doctor driven pieces in mainstream media that have used the fact that some applications have been refused in 2022 as a sign of growing disapproval by local planning authorities when considering solar farm applications.

But numbers are numbers, and the only thing worse than no-market-analysis is bad-market-analysis, which is exactly what has been disseminated in recent weeks when focusing only on refusals and not the massive numbers being approved.

The analysis and graphic shown in the following section reveals for the first time exactly how UK planning authorities have been viewing solar farm applications since solar farms started to get proposed in the UK back in 2010. This includes data from all local planning authorities(LPAs) in addition to NSIPs and Scottish and Welsh Government adjudication.

More than 4GW new solar farm capacity approved in 2022

Nothing ever gets 100% planning approval success. Solar farms are no different in this respect, especially as they scale up in size as we have seen in the past few years.

The best way to view this is to look back in time, and the three different phases of UK solar farm applications. For the graphic below, we have removed Northern Ireland from the traditional UK data, so as to consider GB only (England, Wales, Scotland).

This is done to fit in with national energy needs on the mainland, in addition to the National Grid and distribution network operators (DNOs) at play. Given that Northern Irish solar farm additions have been somewhat historic and low in numbers, the data would only see very minor changes. It is also important to look at GB now in terms of planning activity as this is where all the action is.

The three phases I alluded to above are as follows: 2010 to 2016, when all the planning action was based on Feed-in-Tariffs (FITs) and Renewable Obligation Certificates (ROCs), and where most of the applications were for 5MW sites (aside from a bunch of sites, as high as 50MWac that were ROC incentivised); 2017 to 2019 when the industry was adjusting to subsidy-free and few applications were decided upon; and from 2020 onwards, when sites were starting to get proposed more at the 50MWac level with LPAs and much larger sites for NSIPs (or devolved governments within GB).

The other difference in these phases is the incentives on offer and the role of solar within the overall energy mix going forward. Deployment during 2011 to 2017 happened so quick that no-one at the policy level had time to adjust to the scale of new solar being added to the grid. From 2019, additions are seeing strong government/energy-policy support, both through NSIPs and via CfD auctions. This is probably the most apt retort to some of the comments being made in the public domain in recent weeks.

So, let’s look now at the picture that speaks a thousand words.

Record levels of new solar capacity have been approved during 2022, with much of the newly-approved capacity in 2021-2022 part of government policy-backed energy policy that includes NSIPs and CfDs. Image: Solar Media.

The graphic above confirms that there are always sites refused planning. The more submitted into planning, then statistically, the more there will be refused (and approved). Most often, the one or two that get refused will have amplified local campaign activities widely picked up by regional and national media outlets. But the sites approved (and barely mentioned) far outweigh the few being refused. Furthermore, sites refused are typically at the LPA level and the larger ones typically go to appeal where a positive outcome from the Planning Inspectorate is more likely than not.

Certainly, from a capacity standpoint, there is little difference in the approval/refusal rates in 2021/2022, compared to the other main years of strong solar farm application decisions of 2014 and 2015. If anything, the capacity level refused is lower, with this largely coming from some very large sites being approved at the NSIP level.

There are many nuances in the refusals grouping that could be sliced and diced, from an analytical perspective. To be honest though, the main thing should be the capacity approved, when this will come online, and how it will help the UK get to its climate-change and energy-security targets in the future.

Yes, refusals tend to come in clusters within certain LPAs. And yes, certain developers tend to have better success than others, regardless of where the sites are located.

Since the start of 2021, in GB, there have been 29 solar farms refused planning. A couple each in Aylesbury Vale, Balisdon and Telford & Wrekin. Three in County Durham. So nothing major in terms of regional bias.

Eight of the 29 refused are in Eastern England, which is more a consequence of the volume of applications than anything else. Probably about 20 of the 29 (minimum) will go to appeal, and probably about 5-10 will get approved (maybe even as high as 15 depending on precedence). Therefore, when we come to looking at final refused capacity levels for 2021-2022 (and approval levels), it will almost certainly move to a higher approval rate than even shown now for 2021-2022.

The UK’s case-study for LPA solar farm application indifference resides with Eden District Council in Cumbria. When 5MW solar farms were being proposed back in 2014-2016, Eden Council rejected all 13 planning applications for the 5MW of solar farms in a 14 month period between December 2015 and January 2017. Virtually every time, it was based on “adverse effects to the character of the landscape”. Eight were appealed, and seven of these had the decision overturned and were approved by the Planning Inspectorate. Of the seven approved, only two had enough time to build before the 1.2ROCs/MWh incentive was terminated on 31 March 2017.

Goodness knows what costs Eden incurred on the seven applications overturned. Of course, today Eden – like all LPAs – has updated renewable energy mandates. In 2019, Eden declared a “climate and ecology emergency”. Since then it has a sustainability team and last year commissioned a report looking at solar farm opportunities on Council owned land to help hit the goal of being net-zero by 2030.

So, things can and do change in terms of local perceptions. Today, there are two key solar farm proposals at early stages from private developers/investors, and much bigger than the 5MW sites that were all refused by Eden back in 2016. Perhaps these will form the litmus test on how much sentiment can change.

UK Solar Summit, London, 14-15 September 2022

The timing of the UK Solar Summit in London could not be more pertinent, especially with renewed coverage on energy supply within the UK. A key focus of the event is utility-scale solar farm deployment in the UK, and all the relevant drivers and stakeholders at play now and in coming years.

The two-day event is full of key people in the sector giving quality presentations, and is surely the go-to event for the UK solar sector this year. To attend the event, please follow the registration link here.