Planning activity for new solar farms in the UK remains vibrant. The pipeline of new ground-mounted sites reached almost 17GW at the end of April 2021, with 800-900MW of new sites being identified every month.

While the majority of this pipeline feeds into build plan options in the mid-term (2023 onwards), a subset of these sites are ready to get built. And those that come to fruition in 2021 will ultimately determine if the UK solar industry as a whole (covering all rooftop and ground-mount sites) succeeds in reaching the 1-GW-level of new (and fully unsubsidised) capacity additions this year.

This article summarises the findings from the latest research conducted by our in-house market research team, explaining how the likely large-scale solar farm candidates for 2021 build-out can be ring-fenced. All data is taken from the new, May 2021 release of the UK Large-Scale Solar Farms: The Post-Subsidy List report.

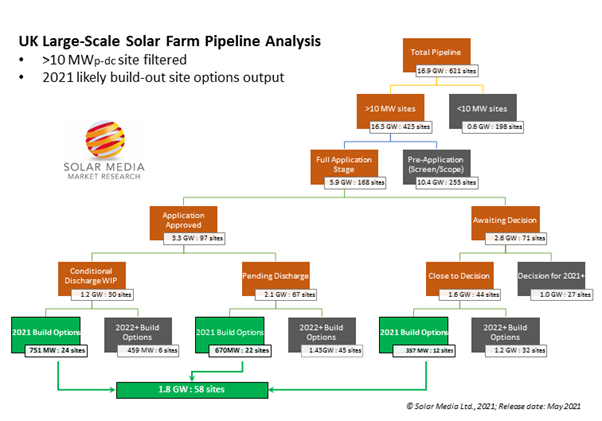

Our analysis starts by looking at the total pipeline of projects (16.9GW across 621 sites), and then applying a range of different filters/conditions in order to end up with the subset of likely candidates that could get built this year. This is shown in the figure below.

58 of the 621 solar farms, making up the total pipeline of large-scale solar farms in the UK, emerge as viable options for build-out in the short-term, amounting to 1.8GW of potential new added capacity. Image: Solar Media.

Let’s look now at how we get the target list of sites, in more detail.

Starting with the total pipeline of projects (16.9GW across 621 sites), the first thing to do is to remove the smaller sites. We use a 10MW cut-off point here. Many of the <10MW sites are specific to public sector, utilities or local councils, and have different criteria driving build-out. Furthermore, this category includes a large number of sites in the 250kW to 1MW range. (Note that our classification of ‘large-scale’ has a lower bound of 250kW, although the pipeline capacity is dominated by sites above 40MW in size.)

Removing the smaller site sizes takes the large-scale (>10MW) pipeline to 16.3GW across 423 sites. These are the main solar farms in play in the UK now, and include the largest sites (>50MW) that fall under the jurisdiction of the Secretary of State or the devolved governments (mainly Wales, then Scotland today).

The next step is to remove sites that are not yet at the full planning application stage. This eliminates a large chunk of the pipeline, as expected. As we have been commenting for some time on Solar Power Portal, much of the pipeline is feeding the mid-term (>2 years out), not what could get built this year or in fact 2022. This bring us down to 5.9GW across 168 sites.

This 5.9GW is then split into sites where planning is approved, and those awaiting a planning decision. It should be mentioned that planning application success is very high for solar now, a combination of planners being highly efficient and local planning authorities less keen to refuse planning applications (for some, once-bitten twice-shy, post ROC appeal failures in the past).

97 sites adding 3.3GW have been approved, with the remaining 71 sites (2.6GW) still being decided. We will return to the pending category shortly, but for now the main focus is on the 97 sites approved.

A key metric here is planning condition discharging. The larger the site, the more likely there are planning approval conditions that developers need to have removed, one by one. In most cases, this is a fairly standard process. The more advanced the approval conditions, the more likely ground-breaking is imminent.

There are 24 sites (751MW) that then fall into the ‘2021 Build Options’ category, shown above in the box bottom-left in the figure.

It is then assumed that a certain number of the sites that are approved now will start discharging conditions early enough in 2021 to become candidates to get built this year. This adds a further 22 sites (670MW) to the 2021 envelope.

Finally, of the 2.6GW of sites (71) that are awaiting planning decisions, we estimate about 1.6GW (44 sites) are close to a positive (approval) outcome. Of this grouping, there is then a potential that 12 of these sites (357MW) could be built during this year.

Adding up the three ‘2021 Build Options’ numbers, this leaves us with 58 sites (1.8GW capacity) that are in the mix for 2021 construction. How many of these get completed this year will ultimately determine if the overall UK solar PV added in 2021 (rooftop and ground-mount) can reach or exceed the GW-level. (Remember that the UK added 660MW in the twelve month period to 31 March 2021.)

Of course, only a handful of this final site grouping (1.8GW capacity, 58 sites) will be built this year. With an average site size of about 30MW, it only takes a small number to quickly add up the built capacity numbers – something we have seen during the past 12 months as large-scale solar farms have been completed in real post-subsidy fashion.

For every stakeholder whose business model is contingent on being attached to new solar farms in the UK (component suppliers, investors, EPCs, sub-contractors, ICPs, O&Ms, etc.), this group of 58 sites should form the prospect list of to-do actions over the coming months.

Even if there is a prolonged pause on site build activity during 2021 (as may happen if module pricing stays high for a few more quarters), then these sites will simply roll over as the lead candidates in a potentially explosive 2022 new-build phase. However, more often than not, somewhere there is a module supplier who is happy to sell product at wafer-thin margins (or at a loss) to win business, and then the somewhat doom-and-gloom scenarios being muted by some module suppliers today become irrelevant. Only time will tell.

For sure, getting your hands on the site data (key stakeholders, build status, etc.) is the only game in town right now. And for this, there is no better reference file than the UK Large-Scale Solar Farms: The Post-Subsidy List report that is updated daily and released at the start of every month.

However, another route for increased market activity now exists. During 15-16 June 2021, we are hosting a new, dedicated two-day event – Utility Solar Summit UK – that will feature all the leading companies involved in the total pipeline of large-scale solar projects in the UK today. The June event will run as an online activity by necessity, but hopefully will create the leads and contacts for many that will form the basis of face-to-face meetings over the next 12-18 months, as indeed many of the short-term pipeline of UK solar farms get built.

To learn more about accessing the UK Large-Scale Solar Farm Post-Subsidy database, or participating in the June 2021 Utility Solar Summit event, please contact us through clicking on the hyperlinks shown above.