Vlachopoulous also praised Britain’s capacity market mechanism, which has been more successful at driving energy storage deployment than other mechanisms in Europe. Image: Getty.

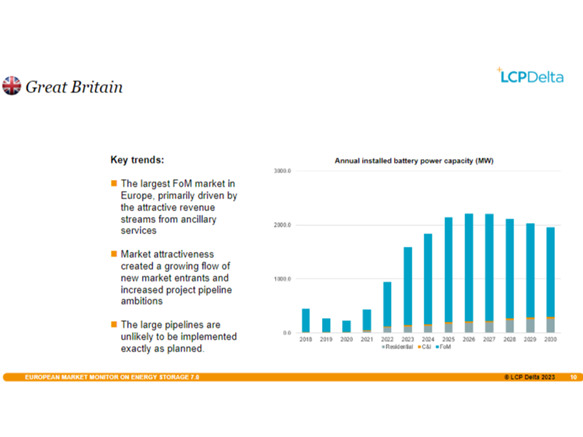

LCP Delta has warned that grid connection and planning permission constraints threaten Britain’s place as the largest EU energy storage market, causing the market to peak as early as 2026/27.

Image: LCP Delta

Speaking during the energy consultancy company’s webinar which provided an overview of European energy storage markets yesterday (28 March), Silvestros Vlachopoulous, energy storage research service manager at LCP Delta said:

“Great Britain has the largest front of the meter storage market in Europe and it’s primarily driven by the attractive revenue streams from ancillary services. The ancillary services market in Great Britain is one of the most advanced in Europe, (as) there are new products, new dynamic services by the National Grid ESO that came online in 2022, which helped the market.”

Vlachopoulous also praised Britain’s capacity market mechanism, which has been more successful at driving energy storage deployment than other mechanisms in Europe.

This means that, although the volume of capacity being secured by storage is still relatively low in Britain when compared to the very low volumes in other markets, it’s “significantly higher”.

Britain is experiencing growing numbers of energy storage projects and more ambitious targets within Britain’s storage market, but Vlachopoulous noted that planning constraints could hinder their development.

“We feel that it will be highly unlikely that the initial [energy storage] targets by companies will be all implemented exactly as planned,” continued Vlachopoulous.

“In our forecasts, we’ve taken in some assumptions with regards to how mature the projects are. So, for example, for a project that had an initial installation date of 2023, if they haven’t already secured planning permission, it’s unlikely that the project will come online in 2023.

“This will create a cascading effect with regards to deployment that you can see with projects seem to be slightly delayed, pushed back and some never been actually implemented.”

Overall, Vlachopoulous forecast that Britain’s storage market will peak around 2026/27, with high volumes of projects but lower volumes of projects that make it online.