Yesterday afternoon chancellor Philip Hammond took to the despatch box to deliver the Autumn Budget. Amidst headline promises of stamp duty relief and fresh funding for driverless, electric vehicles, there were no major pledges relating to the energy market.

Hammond neglected to mention it during his speech but perhaps the most significant policy decision taken with regards the energy sector is the government’s decision not to provide any further levies for low carbon electricity until 2025.

This decision, the government said, has been reached to protect consumers from any further burden caused by levies and their impact on energy bills.

This comes by means of a replacement for the Levy Control Framework – the mechanism used to monitor and control levies passed onto consumer bills – which was due to be replaced.

Meanwhile the Office for Budget Responsibility (OBR) once again revised down its forecast for environmental levies. It now expects spending under the LCF to fall by a further £0.2 billion to £0.3 billion a year out to 2020/21 and by £0.5 billion a year in 2021/22, courtesy of reduced spending under the Renewables Obligation and Contracts for Difference schemes.

While the RO has of course been closed, the OBR’s reduction in CfD costs stems from a higher projection for wholesale energy prices, in turn reducing total subsidy costs paid to contracted generators, and cheaper than expected contracts within the most recent round.

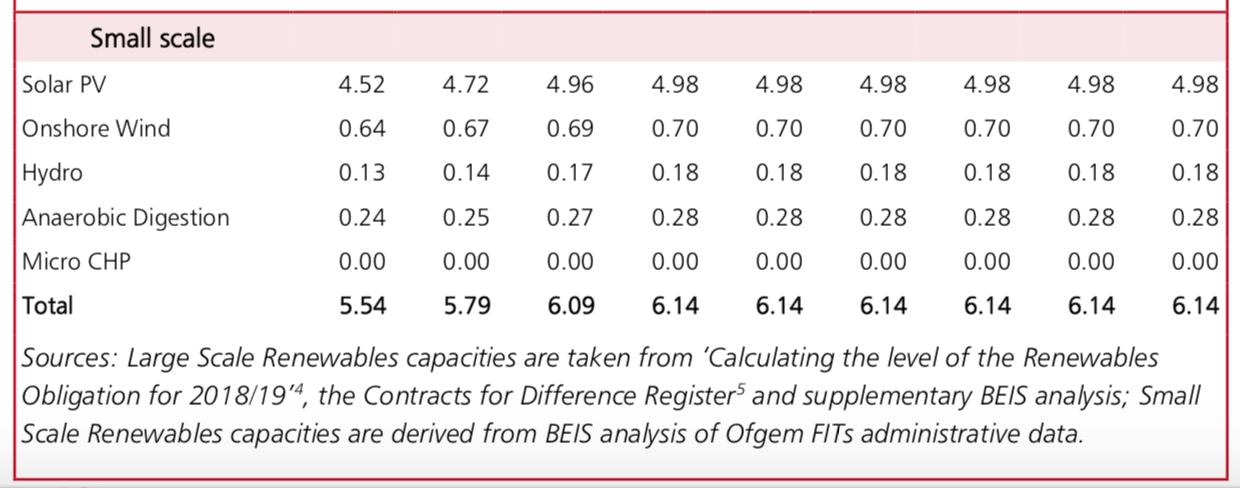

Within the document published yesterday the government outlined a series of assumptions, including the forecasted deployments of different technologies under the various subsidy programmes such as the RO, CfDs and the feed-in tariff.

These forecasts revealed that the government expects roughly 200MW of small-scale, FiT-accredited solar to be installed in this financial year, followed by a further 240MW in the forthcoming year. These would be the final periods of solar deployment under the FiT with the scheme set to close to new applicants on 1 April 2019.

However to reach even that level of deployment would require an uptick in the current trends. Solar has under the current tariffs installed around 40MW of solar per quarter.

It would also leave a significant amount of unused capacity within the feed-in tariff deployment caps, currently totalling more than 200MW.

There is however still no sign of BEIS’ review of the feed-in tariff scheme. It was scheduled to conduct bi-annual reviews of the scheme but has yet to do so. The department is committed to conducting the review before the end of this year so should enact it before parliament rises for recess on 21 December.

The review could form part of the government’s wider proposals for future support frameworks for solar PV in the UK which was promised within last month’s Clean Growth Strategy.

But while the government is opposed to enacting new levies for low carbon power generation, it has opened the door for support frameworks which do not add to subsidy costs on consumer bills.

The precise wording of the government’s forthcoming set of levy controls states that “new levies may still be considered where they have a net reduction effect on bills and are consistent with the government’s energy strategy”.

This could seemingly allow for subsidy-free CfDs to be brought forward, enabling the government to procure additional generation capacity from the cheapest renewables technologies should it need to.

As well as the Budget, yesterday also saw the release of the Public Accounts Committee’s damning indictment of the government’s handling of the Hinkley Point C contract. Within it, the committee has called on BEIS to release a ‘Plan B’ should the project fall further behind schedule and for that plan to be published before the end of this year.

There is also continuing uncertainty over the government’s tax framework fro energy saving materials, with no clarification over some of the issues raised in our blog earlier this week.