Cubico Sustainable Investments has raised around £272 million to refinance a 200MW portfolio of onshore wind and solar PV assets in the UK.

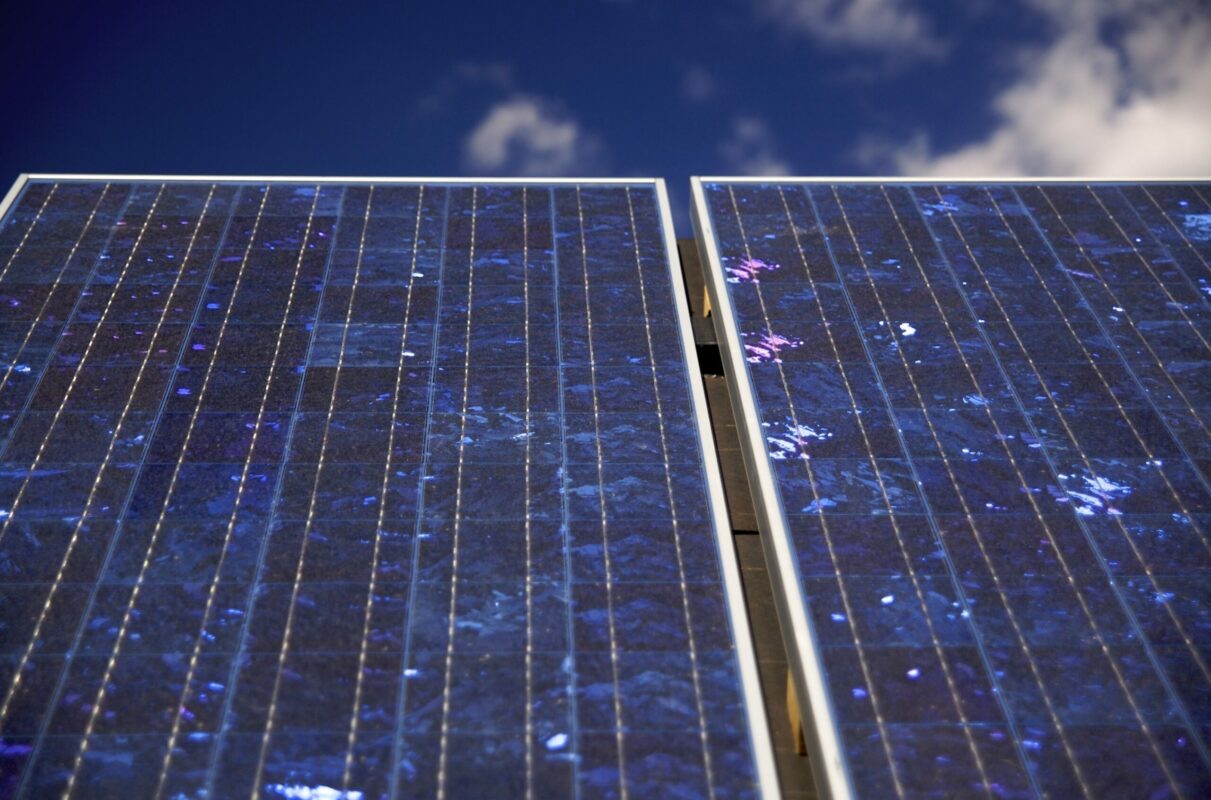

The portfolio consists of ROC- and FiT-accredited operational assets built between 2013 and 2016.

Around £258 million in non-recourse, long-term project finance debt has been raised with an additional £14 million debt service reserve facility also incorporated into the package.

National Australia Bank, Siemens Financial Services, ING Bank and Landesbank Hessen-Thüringen are the mandated lead arrangers which make up the ‘bank club’.

The facility, which matures in 2035, has been structured as an open-ended portfolio to allow for additional renewables assets to be included within it in the future.

David Swindin, head of EMEA at Cubico, said the package would be one of the largest portfolio financings to close in the UK market this year.

Much of Cubico’s stake in the UK solar market stems from its acquisition of a raft of operational assets from UK developer British Solar Renewables in May 2016.