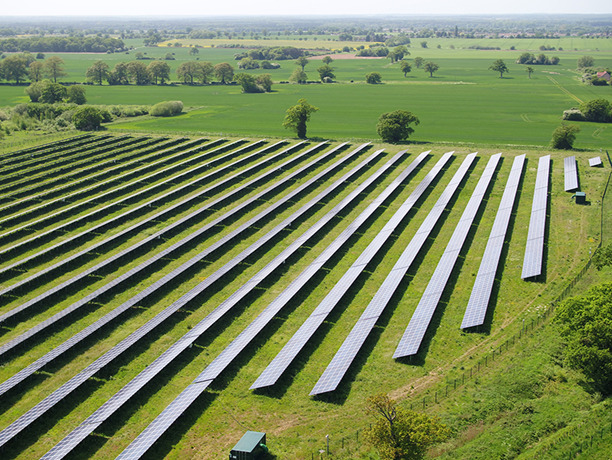

The Kenninghall Solar Farm. Image: Armstrong Capital.

Energy supplier Ecotricity has signed a long-term agreement to supply and purchase Renewable Obligation Certificates (ROCs) from a UK solar portfolio.

The portfolio in question is owned by Solar Growth Limited, an Armstrong Capital-managed vehicle, with the intention of maximising the revenues from ROCs by placing them into a secure long-term deal.

A competitive tender process using the Renewable Exchange platform, an online digital marketplace for power purchase agreements (PPAs), led to Ecotricity being chosen to enter into the 15-year agreement. This, Armstrong Capital said, will allow Solar Growth to focus on optimising its power generation by reacting to the volatility of the wholesale power markets, which is also monitored via the Renewable Exchange platform.

Sam Dickerson, commercial manager at Ecotricity, said that Renewable Exchange provided a “great opportunity”, with the company looking forward to continuing the relationship.

“Sourcing ROCs directly from a renewable generator is crucial for us to meet our requirements along with allowing more sources of green energy to be built,” he added.

Armstrong Capital itself specialises in the management of funding into UK-based solar projects and other energy businesses. Established in 2013, it has managed over £300m of capital for UK solar projects so far, and in January penned a joint venture with Danish investor European Energy to pursue a 500MW solar and storage pipeline in the UK.

Jonathan Hick, investment director, stated that the company is “delighted to have signed a long-term agreement to sell the ROCs from our site to Ecotricity over the full life of the subsidy period”.