A trusted optimisation partner is essential for managing complex routes to market (RtM). An experienced partner provides tailored solutions to keep up with BESS technology and regulations. EDF, a leading RtM provider, uses market expertise and advanced algorithms to help asset owners maximise revenue and protect asset lifespans.

Optimisation Strategies

Batteries can be monetised across numerous markets and contracted obligations. Some are determined well in advance of ‘delivery’, some shortly beforehand, and others in real-time. These include long-term contracts, wholesale trading and balancing mechanism (BM), and ancillary services.

It is possible to ‘stack’ several of these together—segmenting the MWs in your battery and using them for different purposes. However, there can be knock-on consequences from one revenue stream into another, and not all combinations are possible. Battery characteristics such as the warrantied cycle allowance, BM status, and location can materially change how the strategy can be designed and delivered.

Long-Term Contracts

Long-term contracts are awarded directly by National Grid (NG) and offer a reliable income but may impact short-term optimisation. They will typically obligate a battery to discharge a specified volume of energy to the grid in specific situations and their activation may, or may not, be predictable.

While these contracts provide a guaranteed revenue, ensuring their fulfilment affects the battery’s short-term optimisation – owing to their unique state of charge requirements. Further, failing to meet the obligation when called upon results in penalty charges.

Two common examples include:

- Capacity Market (CM):

- Pays either a generating asset to deliver an agreed quantity of output when needed or a demand-side participant to reduce their offtake by an agreed amount if required.

- The asset may not be called upon, and forecasts can predict likely calls. It is paid for its participation in the CM scheme based on an auction-defined payment for its availability to deliver or reduce offtake.

- Black Start:

- An uncommon but important contract used to restart a power station or part of a grid operation following an outage.Requires a minimum level of charge since the event can occur unexpectedly.

- This can affect other market routes and trading capabilities.

Wholesale Trading & BM

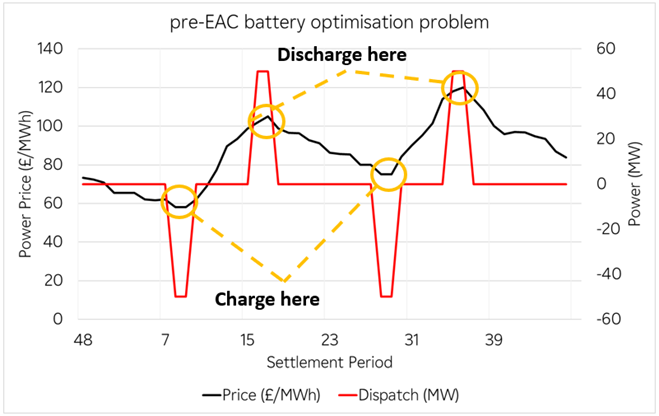

Trading is the basis of any strategy, serving as the primary source of revenue. In its simplest form, batteries can profitably charge at a cheap price and discharge within the same day at a higher price. Higher efficiency allows trading on narrower spreads compared to other assets.

Whilst charging and discharging is a simple concept, there are several markets which the volume can be traded against:

- Forward Hedging: Less volatile with typically lower spreads, derived from a risk-weighted view with lower certainty. This market is less commonly utilised by the current national battery fleet, but this is an interesting RtM that EDF is beginning to offer its battery customers.

- Day Ahead: Several auctions take place the day before delivery. These are highly liquid, and the hourly day-ahead auctions have the most predictable price shape of all in the prompt horizon.

- Continuous within day (intraday): A more volatile market that evolves from the day-ahead profile as final positions become clear. The price can be further pulled by system imbalance expectations.

System Imbalance Prices (SIP) reflect NG balancing actions via the BM. Increasing generation or reducing demand raises prices, while the opposite lowers them. This market isn’t tradable directly, but untraded battery schedules are affected by SIP during the settlement period (SP).

Non-BM batteries can adjust output in real-time based on the SIP, which is driven by the Net Imbalance Volume (NIV)—the sum of NG’s balancing actions. NIV fluctuates during the SP, offering opportunities but also greater risk compared to previous trading markets. Unlike BM assets, which must adhere to NG’s fixed output rules, non-BM assets can adjust their output in real-time.

The BM: BM-registered batteries can submit pairs of bids and offers into the BM, enabling NG to charge or discharge them. These price and volume pairs create opportunities to achieve better than within-day market spreads after wholesale trading has ended for an SP in delivery.

Other adjustments, Non-Energy Costs (NECs) and Triads: The costs and benefits to batteries during triads have evolved. In some cases, there can be an extremely high cost levied for charging but, conversely, an extremely high revenue for discharging during the Triad period. It is critically important that any non-trading contracts don’t adversely affect your triad position (see Response and Reserve Services).

Ancillary Services

New frequency response services are designed for battery assets, utilising their rapid charge and discharge capabilities to manage grid frequency variations. The three markets—Dynamic Containment, Dynamic Moderation, and Dynamic Regulation—offer charge and discharge contracts through daily pay-as-clear auctions for tested batteries.

Dynamic Containment requires the least response and Dynamic Regulation the most, each with distinct costs and opportunities. Response services can be combined with other market routes, but impacts must be considered.

How does everything fit together when building a strategy?

When building a strategy, consider a battery’s capacity, storage limits, and warranty cycle rates. Balancing these factors is crucial for maximising revenue, as each revenue stream affects them. RtM providers set daily strategies for Wholesale Trading, BM, and Ancillary services, adjusting on delivery day to capitalise on intraday opportunities.

The optimiser determines the best mix and uses auction structures for the best pricing.

A prompt-optimisation strategy must consider the following:

- Wholesale trading opportunity: Optimisation starts by valuing the day from a wholesale and BM perspective, which differs for BM and Non-BM batteries due to BM adjustments and NIV chasing. This involves assessing the volume generated and consumed each half hour and the resulting energy price dynamics.

- State of charge impacts of your ancillary service contracts.

- The trading headroom your ancillary service contracts allow.

- Ramp rate implications of your contracts.