The National Energy System Operator’s (NESO’s) publication of the 2025 Future Energy Scenarios: Pathways to Net Zero shows increased optimism in the energy transition outlook.

The Future Energy Scenarios (FES) document is the first to be published under NESO’s remit as an independent body overseeing the whole energy system, but is the fifteenth report of its kind, previously carried out by National Grid ESO.

Like last year, the FES gives an independent view of ‘pathways’ for the whole energy system to follow towards net zero. According to the foreword by NESO’s strategy and policy director Claire Dykta, the last year has been “characterised by action, acceleration and ambition”.

Alongside the three pathways to net zero in 2050, there is a route modelled that represents a failure to meet the legally binding commitment. Last year, this was the ‘Counterfactual’ but FES 2025 uses ‘Falling Behind’.

Unlike before, it is not a ‘status quo’ scenario because it considers the current number of low carbon projects in the pipeline and increased policy ambition leading to some level of progress. Although net zero is not achieved in 2050, Falling Behind sees some decarbonisation progress, albeit not at sufficient pace.

The current government’s push for renewable energy demonstrably already impacts future energy use and carbon emissions reduction.

Pathways to net zero

The three pathways to net zero in 2050 are as follows:

Holistic Transition, in which net zero is met through mix of electrification and hydrogen, latter mainly in industrial clusters, not used as heat except as secondary fuel in heat networks. Consumer engagement is very strong and the pathway also assumes a high renewable capacity, with a sharp drop in gas and moderate levels of nuclear capacity. Supply side flex is high, via energy storage and interconnectors – no unabated gas on the network in 2050.

Electric Engagement sees net zero achieved through electrified demand, with consumers highly engaged in the transition through smart tech. Electric Engagement has the highest peak electricity demand, requiring high nuclear and renewable capacities. It also has the highest level of bioenergy with carbon capture and storage across all the net zero pathways. Supply side flexibility is high, similar to the Holistic pathway with additional provision from low carbon dispatchable power.

Hydrogen Evolution sees fast progress in the hydrogen industry and the heat sector meet net zero. Hydrogen is used for some heavy goods vehicles, but EV uptake is strong. This pathway sees high levels of hydrogen dispatchable power plants, leading to reduced need for renewable and nuclear capacities. Most flexibility in this pathway comes from hydrogen storage.

All pathways see “substantial and continued” development of new power assets and infrastructure.

NESO notes that the government’s Clean Power 2030 (CP30) Action Plan sets a clear benchmark for the required ambition and represents a critical milestone but that, as some in the industry have begun to point out already, it is important that post-2030 efforts maintain momentum.

In the pathways, total installed generation capacity grows beyond 2030: between then and 2040, 116GW-125GW is added, with a further 52-72GW added between 2040-2050.

FES 2025 says this reflects “an ambitious, continued expansion of generation capacity as we move towards net zero”.

In all the pathways the proportion of distributed generation remains comparable to today at around 30-35% but this is as part of a far larger electricity system.

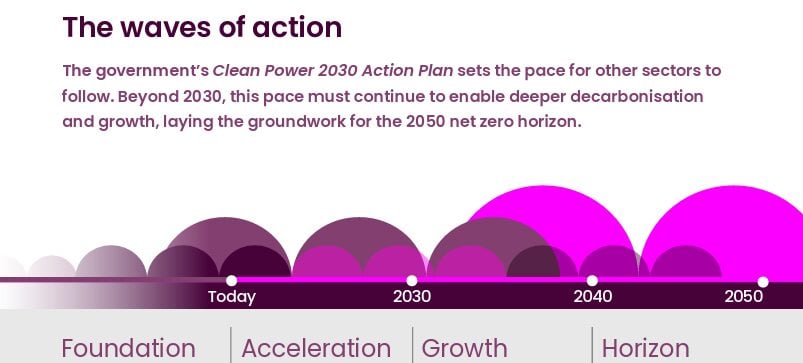

NESO uses ‘waves’ to describe the phases in which progress will occur up to 2050. It says that Great Britain will need to leverage innovation and progress, as each wave has defining characteristics and sets up for the next.

The initial ‘Foundation’ wave has already laid the necessary groundwork for the next wave which focuses on acceleration, scaling up the markets for uptake of new low carbon technologies and delivering clean power.

Rapid action over next five years will enable a third wave enabling energy growth, rollout of new low carbon technologies and infrastructure expansion. The final wave will then embed the transition to a long-term, secure and clean energy system to 2050 and beyond.

As has been qualified in the Climate Change Committee’s advice to government for achieving its carbon budgets, the energy sector is just one part of the transition and FES 2025 states all sectors now need to accelerate their efforts to match the clean power pace and ambition.

FES covers long term uncertainty when developing and assessing infrastructure; it will interplay with other planning carried out by NESO, including the Strategic Spatial Energy Plan (SSEP) and the Regional Energy Strategic Plans (RESPs).

Indicative of the uses for the modelling is the fact that the government’s CP30 Action Plan was based on the Holistic pathway from FES 2024.

FES 2025 identifies four key areas into which the ‘critical enablers’ for success fall:

- Energy efficiency – managing demand growth and reducing cost of energy for consumers. Policy and innovation can enable efficiency improvements and adoption of measures across all sectors.

- Demand flexibility – Greater levels of flexibility offer greater opportunities to make more efficient use of low cost renewable energy. Increased consumer flexibility complements supply side (where most comes from at the moment) and was a big feature of last year’s FES. NESO states: “Making participation effortless and fair would increase confidence in outcomes through consistent positive impact and so is critical for success.”

- Infrastructure and energy supply – infrastructure expansion is needed, and communities need to understand how they benefit from clean energy to encourage support of the expansion. Notably the government’s Planning Bill includes monetary compensation for households near to new electricity pylons.

- Switching to low carbon technologies – this is vital in the transition, but FES 2025 states Great Britain is an ‘engineering powerhouse’ and can harness that potential to enable the development of electrification, carbon capture and low carbon fuel technologies.

Changes to Future Energy Scenarios since 2024

FES 2025 now uses 2030 as the last year of assessing the installation capacities based off pipelines, market knowledge and research, with 2031 now the first year where our capacity expansion module optimises the generation build out.

Minimum build rates are set for nuclear and offshore wind, whereas maximum build rates are set for onshore wind and solar.

The energy demand projected in each pathway is changed slightly on FES 2024 due to changes in macroeconomic assumptions such as GDP growth, population and industrial activity.

Shifts in energy price forecasts, fuel availability and global market dynamics also play a critical role.

Other key changes since FES 2024 was published include major industry developments including the formulation of NESO itself, connections reform, CP30 and, most recently, market reform.

Out to 2030 electricity demand increases at a faster rate than it did in FES 2024, a trend continuing past 2030. Although predictions are higher, the range is slightly larger for electricity demand across the pathways: FES 2024 range of 458TWh-550TWh, FES 2025 is 540TWh-646TWh.

Modelling changes also include a new data centre model. Demand from data centres in GB is currently estimated at 7.6TWh from the 2.4GW connected. These are primarily used in banking applications and thus need to be close to London; build-out for AI use (per the government’s AI Action Plan) could be strategically placed.

With sufficiently strong locational signals, FES 2025 anticipates a maximum of 20% of future data centre demand could be located in Scotland, helping reduce network constraints.

The range of solar capacity modelled has significantly narrowed in FES 2025, with faster growth and increased clarity over the next few years resulting from connections reform changes around co-location seeing projected capacities across the pathways increasing from 42GW-69GW to 56GW-62GW in 2035.

For supply side flexibility through energy storage, battery energy storage growth is increased in FES 2025’s medium and long term capacity projections: from 29GW-36GW to 31GW-40GW in 2050.

The growth rate in FES 2025 is higher than in FES 2024, leading to to lower average battery capacities across the pathways before 2032.

Long-duration energy storage (LDES) sees slower maximum levels of deployment by 2030 as the range is reduced from 3.7GW-5.9GW to 3GW-5.3GW, due to the long lead and planning times and capital expenditure. The value of LDES is maintained though and by 2050 the range increases from 12GW-15GW to 13GW-17GW.

The cost of net zero by 2050

FES is not shaped around optimal cost option, rather presents a “broad view” of possible pathways looking at a range of outcomes across supply and demand, deliberately including different options (some of which will be more expensive) to demonstrate the potential range of uncertainty and options in line with each pathway’s ‘core narrative’.

NESO will publish cost analysis in a technical annex later in the summer, including the estimated costs associated with each pathway and its costing methodology. NESO notes cost estimates are not the same as consumer impact, which is a function of policy and will not be estimated in the analysis.

It also highlights the economic growth and job creation associated with net zero, as well as the reduced volatility and exposure to global fossil fuel price shocks.