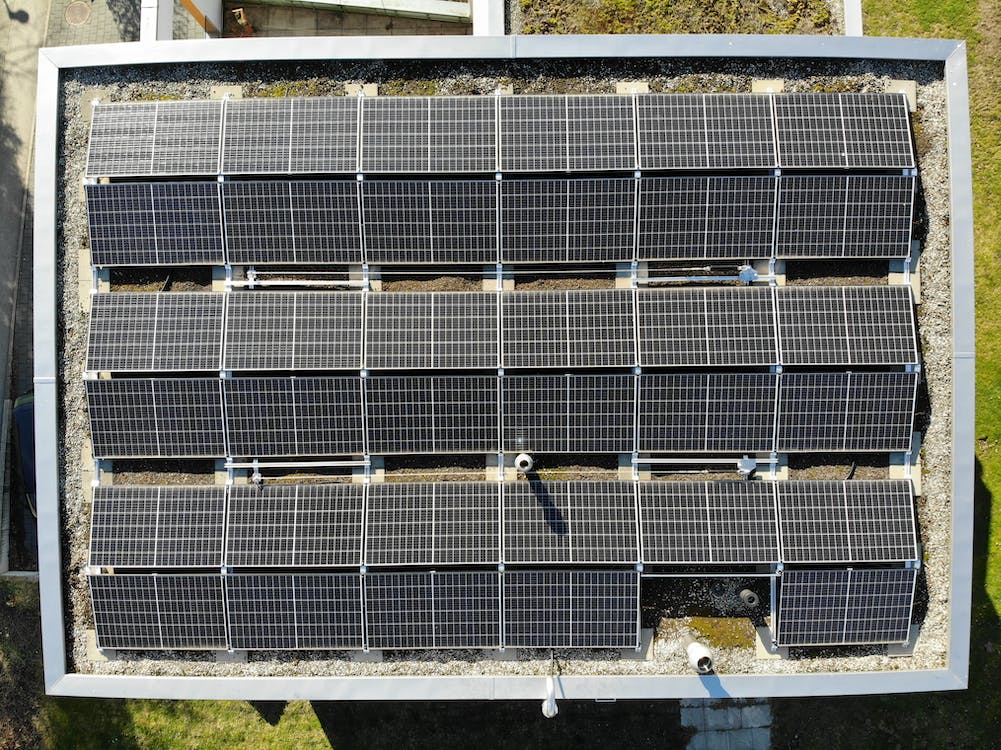

The good news for the solar sector follows a record 2022, when global solar capacity expanded by about 38%. Image: Laurin Berli (Pexels).

Solar will remain the energy sector’s fastest-growing sub-segment, says a Bloomberg Intelligence report, which suggests that demand could soar by 30-40% in 2023.

The good news for the solar sector follows a record 2022, when global solar capacity expanded by about 38%.

Electronics distributor Avnet Abacus recently published data showing that the number of UK solar companies listed on Crunchbase continues to grow year-on-year and in 2022 total investment in the sector was $362 million (around £286 million), with a mean average funding round of $40.2 million (£32 million).

The Bloomberg report added that profitability metrics for solar companies could also improve with cheaper lower input costs and supply chain constraints.

Rob Barnett, BI Senior Clean Energy Analyst, said: “Global solar demand may rise about 30-40% in 2023 with industry revenues increasing about 35%. Despite such fast top-line growth, solar share prices have trailed this year relative to the overall market, though we note that solar shares are performing broadly in line with the energy sector.”

“We believe the rapid pace of growth can be sustained in 2023-25, which may boost sentiment and help lift consensus sales expectations in the years ahead,” Barnett added.

“Rapid solar growth, easing supply-chain disruptions and a potential reversal in commodity prices could help boost Ebitda for most solar-exposed companies in the years ahead,” Bloomberg said in a statement.

The UK currently lacks investment incetives for renewables to match the US's Inflation Reduction Act (IRA) and there are concerns that new solar projects are being delayed by planning rules, grid capacity and lack of clarity on future government policy. This week, however, saw the granting of planning permission to a solar farm which is projected to be the UK’s largest in Essex.

Bloomberg notes that the price of polysilicon – a key input for the solar industry – has fallen nearly 60% since December 2022, which could increase the revenues of module manufacturers, and would eventually feed through to lower costs for other companies.