Companies like Penso – which developed the Minety project (pictured) – are increasingly looking at two duration sites. Image: Penso Power.

The UK added a record high 800MWh of new utility energy storage capacity last year, as the sector moves closer to GWh additions out to 2030 and beyond.

Indeed, the UK’s energy storage pipeline increased substantially by 34.5GW in 2022. By the end of the year, 2.4GW/2.6GWh of battery storage sites had been connected in total.

This article discusses the significant growth of the energy storage pipeline in the past year and what to expect in the coming years.

Energy storage deployment rates

During 2022, the operational capacity of energy storage sites in the UK increased by almost 800MWh, the largest annual deployment figure so far. In the first quarter of 2022, the first 50MW/100MWh (50MW with a two hour duration) project was installed; Stonehill Energy Storage, developed by Penso Power.

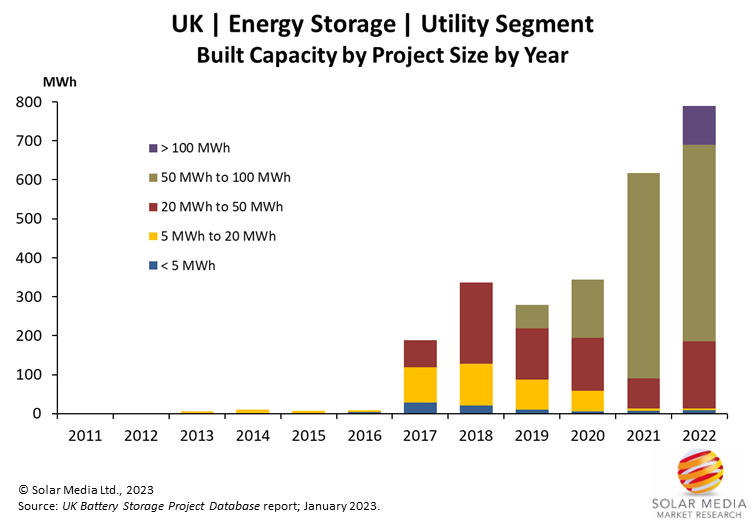

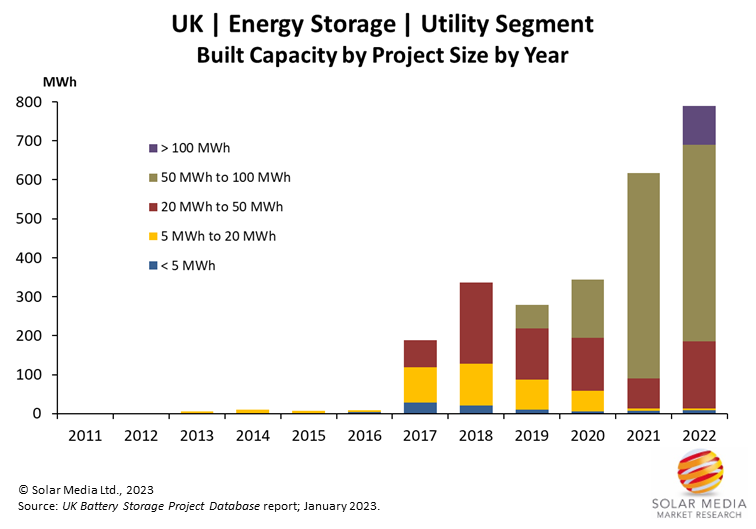

UK energy storage deployment had the highest annual installed capacity in 2022 at 569MW/789 MWh. Image: Solar Media.

The graphic above shows the built capacity of energy storage in the UK by project size by year, where 2022 deployment levels exceeded the 2021 annual installed capacity of 617MWh.

The first major utility-scale battery storage project was energised in 2017 – a 50MW/25MWh project in Pelham, developed and owned by Statera Energy.

Going forward, deployment levels are likely to see annual increases; there is over 2.6GW/4.3GWh of energy storage projects under construction right now which will likely be completed within the next 18 months.

In previous years, there was more of a mix of project sizes, but site capacities are increasing and most projects built in 2021 and 2022 were at least 20MW in size. The majority of these sites installed were stand-alone projects at the 50MW level.

In 2017, there was only one project of size 50MW; in 2021 and 2022 there were nine 50MW projects installed in each year. The average project size in 2017 was 4.4MWh and the average project size in 2022 was 36MWh; this is partly due to an increase in duration of the batteries.

When looking at the asset owners of these operational sites (specifically in more recent years), many are owned by large asset owners such as Gresham House and Pivot Power. These companies have huge pipelines of energy storage projects, which are now starting to be constructed, meaning installed capacity will accelerate rapidly in the near to mid-term.

The majority of projects deployed in 2022 were submitted into planning between 2017 and 2019 and there is still a large amount of pipeline submitted during this period that is pending construction; this indicates further growth of installed energy storage capacity in the next few years.

The build status of energy storage projects

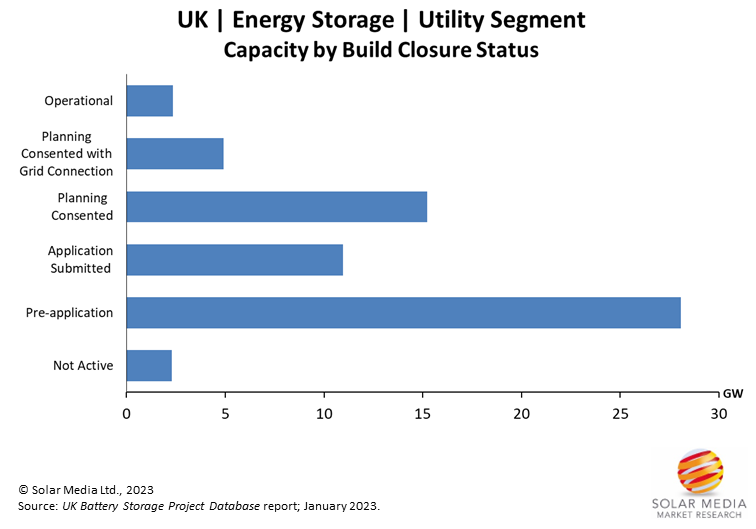

A large amount of projects have been approved in planning, including many projects of 100MW or more. Image: Solar Media.

To summarise the above figure:

- There is now 2.4GW/2.6GWh across 161 sites of operational energy storage in the UK.

- 20.2GW have been approved in planning, including 33 sites of 100MW or more, meaning these projects are unlikely to be affected by any future (possible) planning changes. These projects are expected to be completed within the next three to four years.

- Of the approved projects, 4.9GW also have a grid connection so are either at the construction phase or nearing construction.

- 11GW of projects have been submitted into planning with a decision expected within the next few months.

- 28.1GW are still at the pre-application stage, some having submitted scoping or screening requests. However, some of these projects are yet to submit these, including some large-scale projects in the TEC register.

The projects under ‘not active’, adding up to 2.3GW, have either been refused planning, abandoned, or decommissioned but are still viable for future site activity.

The increasing energy storage pipeline

The total pipeline for UK energy storage is now at 61.5GW across 1,319 sites. Image: Solar Media.

The graphic above shows the submitted capacity of energy storage projects by co-location and by quarter; the total pipeline has now reached 61.5GW across 1,310 sites.

After seeing how successful some projects were in the Enhanced Frequency Response (EFR) auction in 2016, many developers were motivated to submit more applications for battery storage, resulting in a surge of applications in 2017. The rate of submitted capacity then slowed down for a few years, but since 2021, the submitted capacity has been increasing significantly.

During 2021, the pipeline jumped by 11GW to more than 27GW, partly due to the increase in the 50MW threshold and because companies are becoming more experienced in the services available, allowing for more attractive revenue streams.

2022 shows a record-breaking annual planned capacity of 20.7GW across 295 sites, including some 500MW projects and a 1GW project. Most of these projects are expected to be at least two hour duration batteries (compared to 2017 where projects had a duration of 0.5 or 1 hour).

For battery storage sites, project size usually depends on the type of project being developed. So far, the most common size for energy storage sites has been 50MW (although sites are now being planned larger). However, battery storage capacity tends to be smaller when co-located with solar and other renewables.

The planned capacity is becoming increasingly dominated by large-scale projects. In the first surge of submitted applications in 2017, 4.8GW across 238 sites were submitted throughout the year. However, after the lift of the 50MW threshold in 2020, the next surge of applications in 2021 had 11.3GW across 229 sites submitted. The number of applications is very similar but the capacity difference is huge.

More than half of the capacity submitted during Q3’22 (4.4GW out of 7GW) is from sites larger than 100MW and almost all of the capacity submitted during this period (6.5GW out of 7GW) is from sites larger than 50MW.

It’s fair to say the significant movement during 2022 suggests a highly promising future for the UK energy storage market and we are likely to see large amounts of energy storage capacity being connected in the coming years.

All data and analysis shown in this article comes from our in-house market research at Solar Media Ltd. Full details on how to subscribe to our UK Battery Storage Project Database Report can be found here.

This article originally appeared on Solar Power Portal's sister site Energy Storage News.