Solar and storage technologies would possess a “mutually beneficial interaction” in the Capacity Market (CM) should renewables be introduced into the mechanism, National Grid has said.

However solar PV would stand to have an almost negligible role within the mechanism, and any solar projects seeking a CM contract would have to do so with a de-rating factor of between 1 and 2%.

The findings were unveiled within a consultation document that was unveiled by the Electricity System Operator yesterday, the starting block of a piece of work which could culminate in renewables being able to participate in CM auctions in the future.

While the introduction of renewables would require policy movement from both government and Ofgem, as the ESO it would be National Grid’s responsibility to facilitate the auctions and apply appropriate de-rating factors to projects seeking approval.

National Grid said that it had decided to apply an incremental Equivalent Firm Capacity calculation – defined as the precise amount of reliable firm capacity a resource can displace while maintaining the same level of risk on the system – which had resulted in de-rating factors for solar and both onshore and offshore wind.

The same methodology was used to determine the de-rating factors applied to battery storage projects of various durations last year.

Those EFC calculations are crucial in determining the indicative de-rating factors for renewables and solar PV will be faced with de-rating factors of 1.17% for the T-1 2020/21 auction, 1.76% for the T-3 2022/23 auction, and 1.56% for the T-4 2023/24 auction.

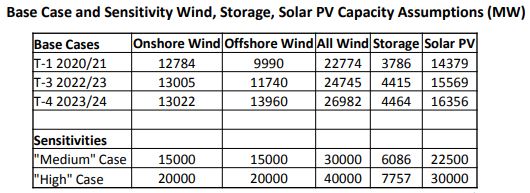

However the ESO also produced some interesting datasets within its base case assumption, specifically guiding that the UK’s solar capacity is expected to reach 16.35GW by the 2023/24 delivery period.

National Grid is forecasting for 14.379GW by 2020/21 – corresponding to next year’s winter period, or November 2020. With the country’s PV capacity currently standing at just over 13GW, that would imply National Grid is forecasting around 1.2GW of new-build solar capacity to come online in the next 20 months.

Judged against BEIS’ forecasts for small-scale solar deployment without the feed-in and export tariffs, which stand as low as 50MW per quarter, the majority of that deployment would fall within the utility-scale category.