Today, we continue our coverage of the Top 20 EPCs to the UK market, with companies filling the positions 12 to 16. Yesterday, we covered companies ranked from 17 to 20.

Similar to the blog yesterday, we provide a brief summary of the company’s activities in the UK solar market, and specifically large-scale ground-mount solar, while also highlighting some of the more interesting issues that emerge from the strategies at play.

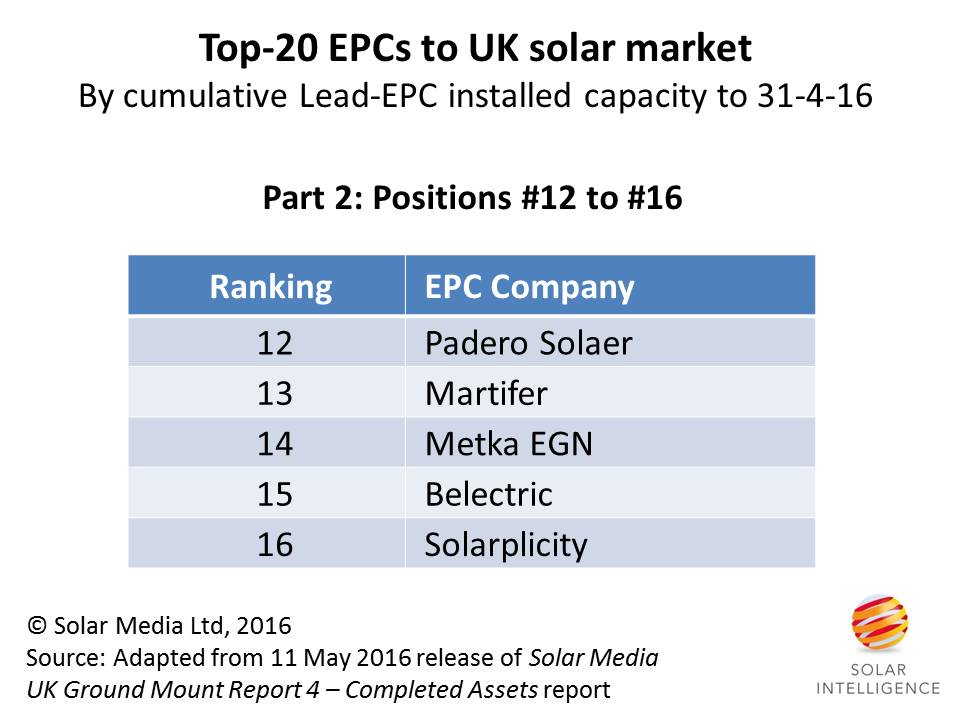

Our second grouping covers companies in positions #16 to #12, shown below.

Each of the companies occupying positions 12 to 16 in the Top-20 EPCs in the UK can be seen to have a very different business model, ranging from being a third-party arms-length EPC contractor to a fully-integrated downstream business holding completed sites.

Our group under review today could not be more different, ranging from global household names (Padero Solaer, Martifer, Belectric) to a company that will probably not be known to many of our international readers on Solar Power Portal in Solarplicity. So, let’s capture now what has been behind these companies installing a considerable amount of solar PV in the UK in the past few years, and just missing out on Top-10 inclusion.

16: Solarplicity

UK based Solarplicity is certainly one of the most interesting companies to be reviewed so far in our Top 20 EPC countdown. In fact, if you were to draw a line in the sand about six months ago, and reset the clock of all EPCs to zero, then Solarplicity would be well inside the Top-10, but based on cumulative installed megawatts dating back to 2010 and well before Solarplicity’s move into EPC activity, the company occupies position number 16 right now.

In looking at the other companies in our grouping today, few would dispute that in terms of versatility, creativity and the ability to quickly change business model, Solarplicity is in a league of its own when it comes to UK solar.

Privately owned and based in the UK, Solarplicity has been through name changes and business model re-organizations as needed by policy changes to UK solar. While not alone in this regard, what differentiates Solarplicity is the instant success it has had since moving into the ground-mount space and building large-scale solar farms.

Not unlike some other UK-based companies featuring higher in the rankings, Solarplicity operates somewhat in a stealth mode, dispensing with the fanfare of marketing activities some others employ every time they get a contract, build a solar farm or sell off an asset.

Tracking Solarplicity’s rapid build-out of solar farms in the UK over the past 12 months in particular has been fascinating, and while others have been retreating from the market, the opposite would appear to be true for Solarplicity.

With residential, commercial and utility offerings to the UK solar market, covering both rooftop and ground-mount installations, and the ability to access finance, Solarplicity is probably one of the most important companies to track as the UK moves to post subsidy in 2017.

15: Belectric

Another German-based engineering contractor, Belectric is one of the most well-known companies to feature in the Top-20 listing, and the company has an impeccable track record of being the EPC-of-choice to many project developers, across a range of global solar PV markets.

The company entered the UK ground-mount sector in 2013, and was largely selective in the projects for which it was engaged. Of special note for Belectric, in contrast to almost every other EPC active in the UK market since 2010, has been its preference for thin-film panels.

Having been the flavour-of-the-month for new-starts to solar manufacturing in the 2006-2010 period, thin-film panel output today is all about two companies: First Solar with CdTe, and Solar Frontier with CIGS. And indeed, these two module suppliers formed the cornerstone of Belectic’s EPC activities within the UK during the past few years.

About 18 months ago, Belectric was flying high in the UK, having completed the 40MW-plus installation at Abingdon using First Solar modules, and at this point, there were strong signs that the company’s market-share for ground-mount installs would see considerable growth.

However, a range of factors conspired to stall these ambitions, including key partner First Solar’s strategic switch to using in-house produced modules for its growing in-house global downstream project pipeline. In effect, this impacted on third-party EPC clients, such as Belectric, in terms of having a global powerhouse in First Solar supporting its solar farm aspirations. Solar Frontier also chose to partner with a different German EPC as it stepped up its efforts to get more ground-mounted installs in the UK during 2015.

Another interesting aspect of Belectric’s UK ground-mount efforts was the company’s early moves to capitalise on community based projects, spearheaded through its Big60Million initiative. While community based projects in the UK would ultimately be stimulated (and overtaken) by split grid connections using community FiT and 2015 pre-accreditations, the marketing unfolded by Belectric and involvement of the public in its Big60Million sites certainly played a strong part in putting the whole community ownership of solar farms on the UK map.

14: Metka EGN

Occupying the number 14 position, Metka EGN is part of the Greek based Egnatia group of companies, and has become a specialist EPC in the UK for a range of different developers in the past two years.

Metka EGN has seen strong growth in UK EPC business levels in the past six months, and is likely to benefit from continued build-out of 5MW sites under 1.2 ROCs over the next few months.

13: Martifer

Similar to Belectric, Martifer Solar is now a global brand. Based out of Portugal, the company’s focus covers not just EPC work, but related development, asset ownership and O&M. Martifer’s presence in the UK began at the start of 2013, during the 2ROCs boom phase of large solar farm build-out.

The company’s role in UK solar farms has been a combination of pure-play EPC, and dual site developer and EPC work. Martifer shifted quickly to the upstream space with in-house developed sites coming online at the start of 2014.

In the past 12 months, UK based efforts have been more heavily weighted to acquiring shovel-ready sites, building them and then flipping them to an institutional investor’s portfolio.

With strong business in overseas markets, including emerging solar regions, Martifer has no shortage of target countries to focus on going forward. But with a strong credibility in O&M, and prioritised as a key company activity, it is likely Martifer will continue to be present in the UK up to and beyond the ROC expiry point.

12: Padero Solaer

Spanish developer Padero Solaer (or Padero Solar) operates in the UK under the banner of PS Renewables, and has been highly successful within the UK both in developing sites, acquiring and enabling shovel ready sites from third-party developers, and retaining a strong O&M portfolio.

Indeed, the breakdown of EPC sites is very much a constant mix of self-developed and third-party developed sites, going back to 2012, with the ability to buy packages of shovel-ready sites being a key strength of the company.

While the number of sites built in the past 12 months has been well below most other companies featuring in the Top 20 EPC league table, the company was successful in bringing online one of the last mega solar farms a few months ago, being grandfathered under the May 2014 changes to the RO scheme by DECC.

With an almost depleted developer based pipeline today, any ongoing activity in the UK will need to be based on further site acquisition, or retaining O&M activities on completed or third-party build sites.

The Top 20 EPC list continues tomorrow, with companies holding the ranking positions from 7 to 11 revealed and discussed.

All data used in the Top-20 EPC methodology is contained within our Solar Media UK Ground-Mount Report 4 – Completed Assets report that includes a full audit trail of completed solar farms in the UK, with updated releases delivered to subscribers each month.