Solar Media Market Research analyst Josh Cornes tracks the time solar PV developments spend in the planning system, as delays and refusals slow the rate of buildout.

Solar PV buildout in the UK continues to pick up, with year-on-year growth forecast for 2025, the seventh year of growth in a row.

With government-led initiatives like Clean Power 2030 (CP30) encouraging buildout and the Contracts for Difference (CfD) mechanism incentivising development, this growth is unlikely to slow down.

However, there are several factors at play stunting this growth, hurting the UK’s chances of hitting the CP30 target of 45-47GW solar generation capacity by 2030.

Two major factors in the timeline for projects to be completed are grid connections and planning.

Developers obtaining grid connections before realistically planning to build a project, back when it was cheap and easy to speculatively get a connection date, have clogged up the connection queue with ‘zombie’ projects. The knock-on effect of this is that projects going through development now are being given connection dates up to 13 years into the future. Some are being mechanically completed but taking over another year to be fully connected to the grid.

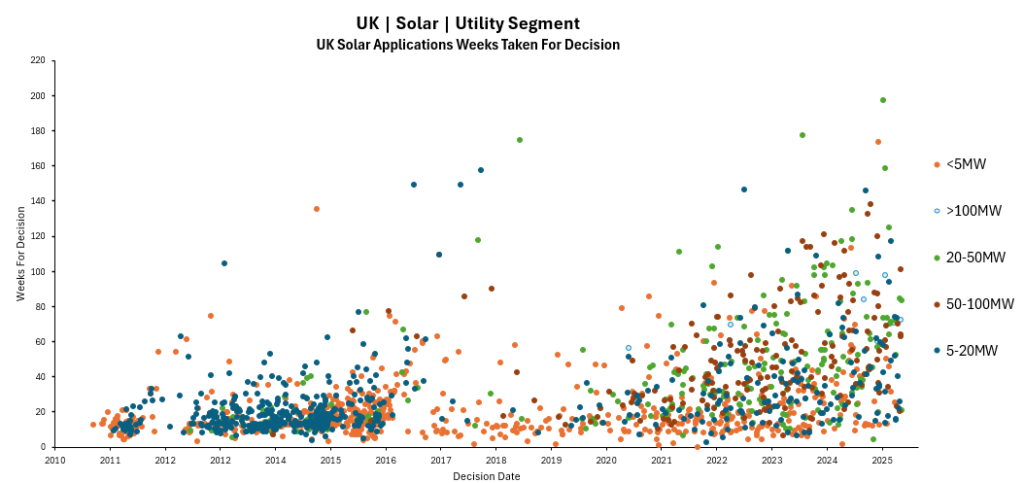

Planning is also essential when looking at a project’s timeline; Figure 1 shows every approved project in the UK that did not go to appeal, and how many weeks passed between submission and approval.

Figure 1: UK solar applications continue to take longer through planning, with the variance increasing, making it harder for developers to plan for the future.

Between 2010 and 2015, when UK solar was at its peak, the average time for a project to get approval was around 29 weeks, albeit with some anomalies. Although the average capacity of projects was significantly lower, the majority being in the 5-20MWp and a scattering in the 20-50MWp range, there were a huge amount more, with over 1,600 submissions in 3 years.

Looking further along the line, 2020 is when projects began to go into planning again, and although there weren’t a particularly large number, there is an immediate distribution of points, with some projects submitted in 2019 being approved almost 140 weeks later.

This set a precedent for the coming years as projects took longer to go through planning. The current longest time for a project to go through planning at Local Planning Authority (LPA) level stands at 177 weeks, having been submitted in 2020 and approved over 3 years later. This could be beaten, however, with 3 projects submitted in 2021 still awaiting a decision, including a 21MWp site and a 24MWp site.

Significantly, although the process is far more rigorous, nationally significant infrastructure projects (NSIPs) go from submission to approval faster than a lot of LPA level projects, with decisions taking anywhere between 56 and 90 weeks. One exception was the Sunnica Solar Farm, for which a decision was pushed out until after the General Election in July 2024.

Local opposition is a significant factor causing this delay, with opposition to projects increasing YoY. This is often the result of a lack of understanding about the key benefits of solar power plants, and educating locals is increasingly a focus for developers and something that must remain central as a crucial part of the planning process.

Another cause is the lack of training and staff at LPA level, seeing developers have to ‘hold hands’ with authorities through the planning process. There are a large number of hurdles and conditions that need to be discharged before a project can be built, with long, drawn-out processes like land surveys and checking archaeological conditions needing to be sped up if not in some cases skipped.

In 2025, developers see 10 months for a decision as a success, with a target of a year for higher end LPA capacity projects. The average wait time in the previous 5 years has been about 45 weeks, with the wait period increasing YoY.

Although there are some projects taking up to three years, there are some projects also moving swiftly through the process. South Kesteven District Council have led the way, approving two projects submitted in December within five months; one 39MW site only took three months to go through the process. Shropshire Council is another with two approvals in the same time period although it gets a much larger volume of applications, and has a higher refusal rate than we’d like to see.

How are planning refusals affecting solar development timelines?

Planning refusals are a major roadblock when developing a solar power plant. The refusal rate since the start of 2024 is almost at 25%, the highest we’ve ever seen, and up on the 15% and 20% seen in 2022 and 2023.

That a site will mean “loss of high-grade agricultural land” is a common reason given by councils, an easy excuse that sees the majority of projects then go to appeal and be approved. Over the past five years there has been an 80% success rate for projects at appeal and in 2025 so far there has been a 100% success rate (12 projects).

Other developers decide to go down the resubmission route, taking into account feedback from the refused application and council recommendations, going back into planning for another attempt at approval. Both processes waste a lot of time, with the average time from the original submission to approval at appeal taking almost 2 years, over double that seen with projects that get approved by the local planning authorities, with some projects either being withdrawn at appeal or refused, delaying the projects further.

Some LPAs are fantastic for solar approvals: Scottish councils such as Fife, Angus, Aberdeenshire and North Ayrshire have approved almost 40 projects since 2022, and only refusing three. Other councils such as Wiltshire, East Riding of Yorkshire and Northumberland also have a strong success rate with 34 projects approved and only three refused between them.

Successes like these show that with local backing and a positive outlook at council level, there is potential to push toward the targets set out by the National Energy System Operator (NESO) ahead of CP30.

It’s been announced that the application period for developers to prove “strategic alignment” with CP30 is now July, with results being privately announced to developers in September 2025. There is expected to be a lull in applications during this period with developers sitting on their hands waiting for their gate 2 grid connection offers. This may present a fantastic opportunity for LPAs to catch up on the pre-existing planning applications.

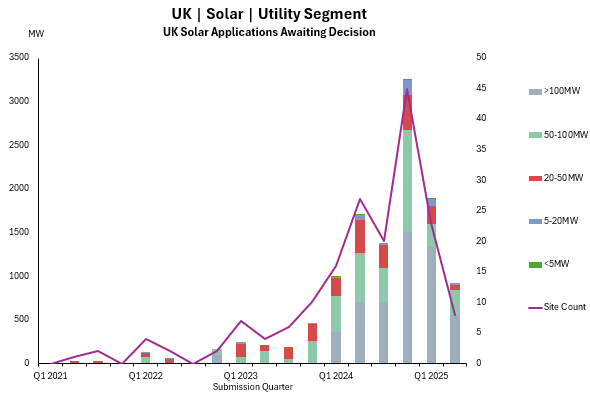

It’s clear that grid connections aren’t the only barrier when looking at the targets for CP30. Planning has to be sped up, with just over 21GWp of solar currently operational in the UK, 25GWp of utility scale ground approved and 15GWp either at appeal or awaiting decision, the projects at pre-approval need to begin to be pushed through faster. LPA’s also need to work on refusal rates and get over any fear of upsetting local opposition.

All the data above is taken from Solar Media Market Research’s analysis, which can be accessed here. To book a demo and access the data please email [email protected].

Representatives from Solar Media Market Research will present at our publisher Solar Media’s UK Solar Summit in July. To see the agenda and book tickets, visit the site here.