The pipeline of large-scale, ground-mount, utility-based solar farms in the UK reached 7.31GW at the end of March 2020, consisting of 357 sites of 250kW and above. Of this, 245 sites are rated 5MW and above, adding up to 7.17GW. Over 1GW of new projects were added to the pipeline during the first three months of 2020.

This article summarises the breakdown of the 7.31GW of pipeline capacity in the UK, and looks at how the current changes impacting the domestic and global economy are offering a window for potential site suppliers (EPCs, sub-contractors, and module, inverter and mounting/tracking) to get a full overview of site stakeholders leading into the expected rebound in build activity later in 2020 and especially during 2021.

All data is taken directly from the April 2020 release of the UK Large-Scale Solar Farms: The Post-Subsidy Prospect List report from our in-house research team at Solar Media Ltd. Details on how to access the monthly-updated list of projects in the database can be found using the link here.

Analysing the latest report data

The total pipeline of 7.31GW is spread across sites at various stages of pre-build planning; screening/scoping, full planning applications, approved sites subject to pre-build conditions, sites undergoing pre-build conditional discharge, and finally sites that have started the site build phase.

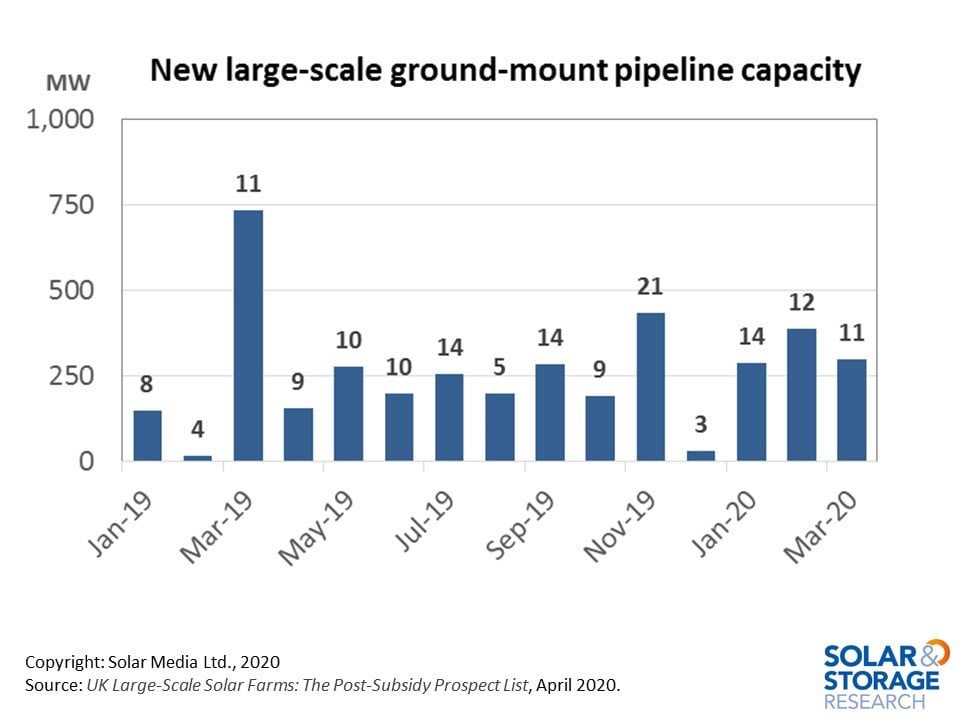

The first graphic shows the evolution of new sites/capacity added to the database each month, going back to January 2019 when real post-subsidy activity commenced in the UK.

Since March 2019, there has been a constant flow of new planning application scoped or submitted in full application format to local councils. The large uptick in March 2019 comes from the addition of a single nationally significant infrastructure project (NSIP) site to the pipeline. Otherwise, there has been a steady flow of about 10-15 new projects each month. Many of these projects are at the 49.9MWp-dc level, consistent with planning that does not require national grid approval.

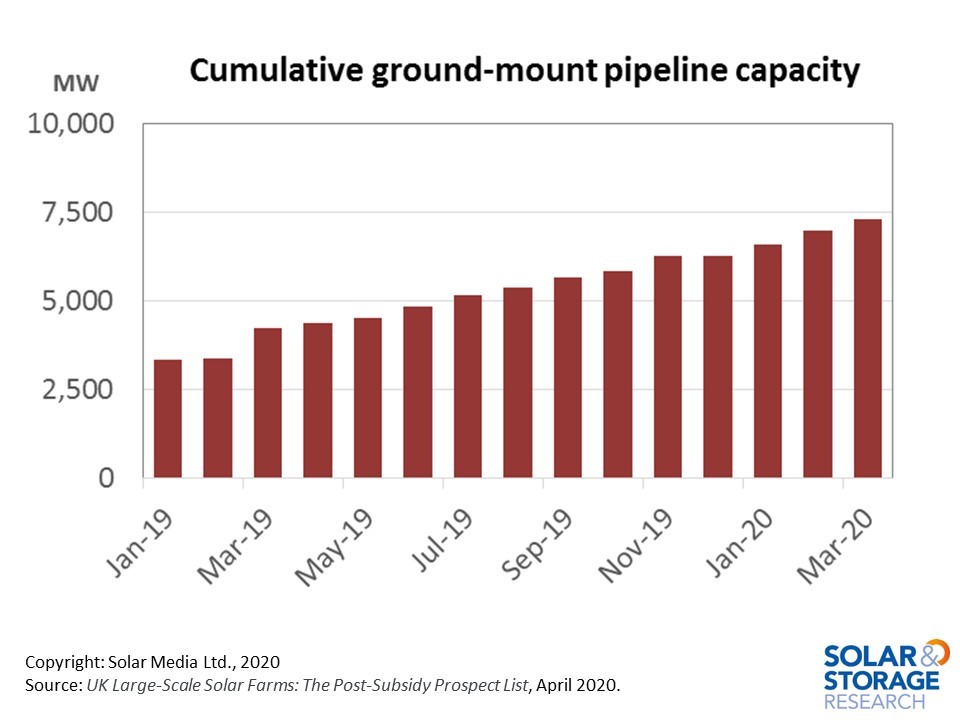

The next graph looks at the growth of the pipeline. During 2019, there were a few projects completed. When projects are completed (or abandoned), they are of course removed from any pipeline analysis.

When we undertook our forecasts for 2020 capacity builds at the start of the year, there was confidence that new post-subsidy UK solar farm additions would be at the GW-plus level. However, this is clearly unlikely to happen when re-assessing 2020 activity now.

Right now, forecasting is impossible. This is as true with UK solar as it is globally. The only thing that is certain is that new capacity added will be drastically curtailed until at least year-end, and possibly most of the capacity that was expected to be added in 2020 will simply move to 2021.

The only upside for solar farm build-outs in the UK is that no-one was rushing to build, prior to a subsidy/incentive being in place and having an end-date. In a post-subsidy world, this is a thing of the past. At the end of this article, I will provide more thoughts on what the 2021 build-phase could look like and what new challenges and opportunities could emerge here, based on a 6 – 9 month ‘pause’ period.

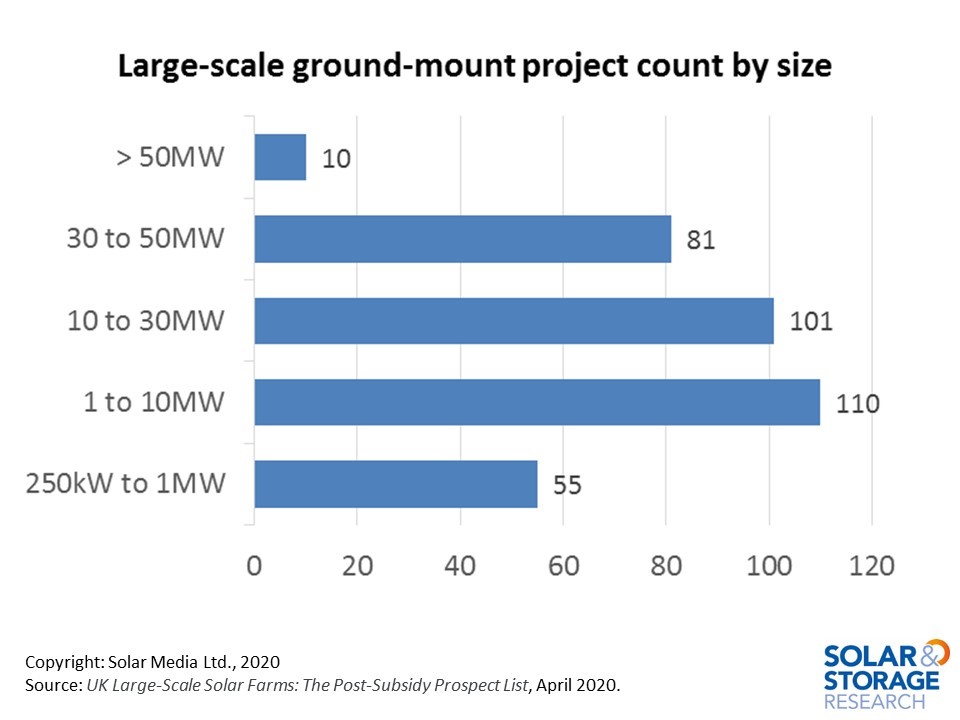

The next graph looks at the size of the individual sites in the pipeline today.

The most common new addition these days is based on 49.9MW sites, many having a planning caveat that energy storage could be added if market conditions are positive at the time. For those hedging their bets, this offers a fall-back position. However, many of the experienced planners (Elgin Energy and Lightsource BP in particular) are fully geared to solar-only and making the numbers work on the benefits of solar.

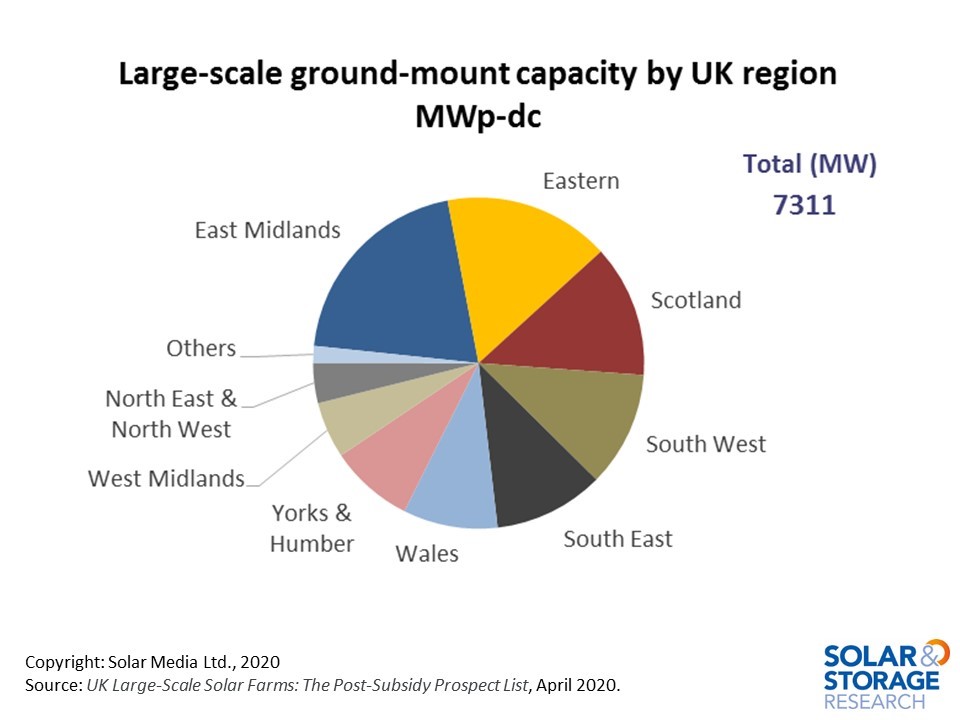

The final graph below looks at where the solar pipeline capacity is located across the UK.

Impact of COVID-19

Trying to offer any specifics in the next six months for UK solar (or indeed any industry) is impossible. Instead, what would seem more prudent here is to look at what some of the long-term changes may be assuming that 2020 is largely a wipe-out, and 2021 is then a year of full-steam-ahead.

This allows some issues to be discussed in a more lucid manner, rather than plucking out revised forecasts for this year based on speculative guesswork.

First, if we look at the pipeline of large-scale UK projects, this is only going to grow and perhaps with site planning still able to operate in the current climate, at a faster rate than would otherwise have happened. In fact, while much of project developers’ time is spread across site identification, scoping/screening and the full planning application documentation, once projects move to pre-build or build phases (with or without any legal ownership changes on SPVs), developers tend to move from new site identification to existing site closure.

If we remove the build/close phases of greenfield site planning, then by default we have more time to find new sites and simply build up larger portfolios in time for when real action starts on building the sites. This of course assumes that the developers have cash to do this; the larger ones will but the more speculative one-man developers will be unable to do this. Fortunately, it is the more solvent entities that have the luxury of building up hundreds of MW of shovel-ready sites.

If this scenario unfolds, then it now offers companies looking for business from the build-out phase (EPCs, sub-contractors, component suppliers) more time to get their prospecting done. Therefore, any companies that were worried they were going to miss out on the previously-forecast GW-level of UK ground-mount activity in 2020 now have a new chance to get onto the shortlists of site investors/owners moving into 2021. The key thing of course is simply knowing the sites in question, and who the key stakeholders are across the 7.3GW of capacity in the pipeline now.

The final issues that may occur in any 2020-to-2021 build-out shift comes from the component manufacturing side.

Module pricing (and indeed inverters and mounting/tracking) is going to collapse during this year. It is hard to see any other outcome. And we know one thing very clearly from the industry: when prices collapse, they do not recover to former levels. Therefore, this will only help in a zero-subsidy end-market that needs every last percentage of upfront capex to be taken out of projects.

Also, module powers/efficiencies will be that bit higher in 2021 compared to 2020. This activity continues at breath-taking pace in the solar industry today. Essentially $/W pricing could easily be 20-25% lower for the projects that were set to break ground in 2020 before.

Finally, again at the component supplier side, we have to consider company-specific financial health. Most module suppliers for example have been operating on wafer-thin margins until now. Any shock to the system of these companies can quickly shift debt to levels where there is no way back. This perhaps suggests that investors should have multiple supplier options, and expect that a bunch of companies will exit the industry or simply have product that is unbankable in practice.

Accessing pipeline data is key in the absence of networking events

With global travel on hold indefinitely for now, many companies are seeking to fill the gap that such networking events traditionally offer. In this respect, simply knowing all sites in the pipeline and the key stakeholders to engage with remotely could be the best use of the next few months until build-out phasing is better known.

To find out how to access this list – updated monthly, details on how to subscribe to the UK Large-Scale Solar Farms: The Post-Subsidy Prospect List report are listed here.