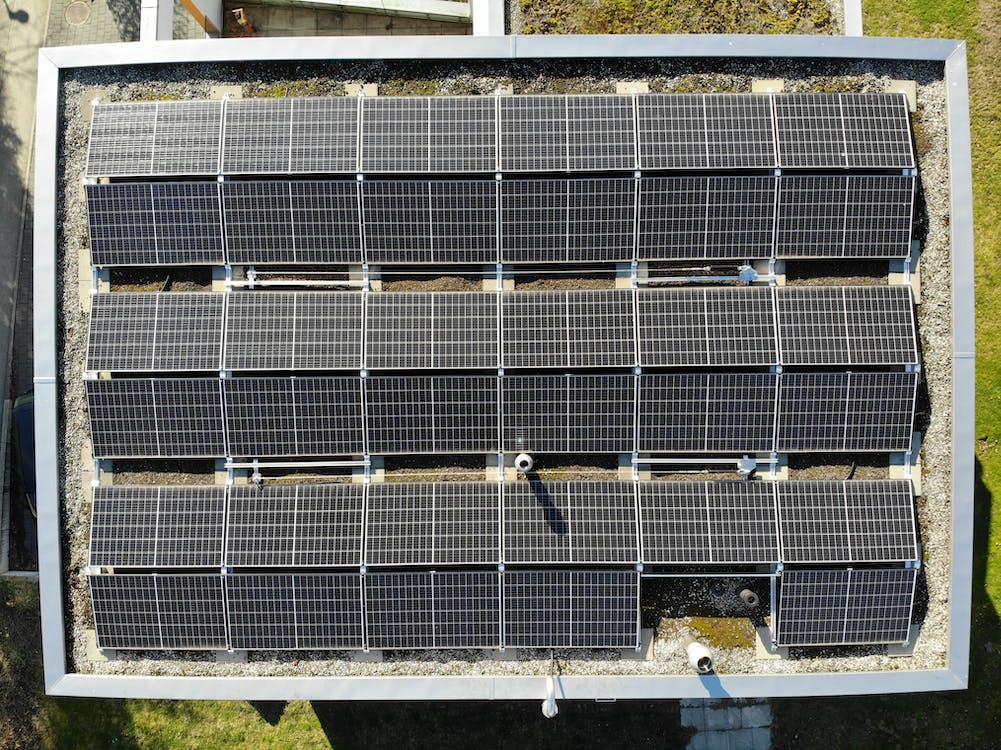

Why business demand for renewables is an opportunity for independent solar generators. Image: Pexels.

This article was written by Vish Sharma, head of power purchase agreements at npower Business Solutions.

Energy is a hot topic at the moment, particularly in terms of how the UK can accelerate the move to a safe, sustainable and secure energy system.

As such, the Department for Energy Security and Net Zero (DESNZ) recently announced a raft of consultations and measures designed to put the UK on the right path to energy independence and a zero-carbon future.

These followed the launch of the Solar Taskforce earlier this year, which has ambitious plans to increase installed solar capacity, particularly by harnessing what it calls the ‘untapped potential’ of commercial solar assets – those on the rooftops of warehouses, car parks and commercial buildings, as well as land-based arrays.

At the same time, businesses are ramping up their sustainability plans. As a business energy supplier, we are seeing increased demand from corporates who want to procure their energy supply from a homegrown renewable source, both to meet their own sustainability objectives, and reduce their reliance on the volatile wholesale energy market.

So, as we move to more renewable supply, we agree that solar power has a hugely important role to play.

However, the fact remains that demand for renewables is outstripping supply. In addition, one of the barriers to increasing the volume of solar, and any renewable power, on the UK’s electricity grid, is the long-lead times for grid connections.

While National Grid ESO recently announced targeted reforms to speed up connections to the electricity grid, with a strong ‘get on, get back or get out of the energy queue’ approach to root out so-called ‘zombie’ projects, this won’t happen overnight.

As a result, for existing independent solar generators, or those considering investing in a solar asset, this presents a real opportunity to not only play a key role in the wider energy system, but also to meet the demand for renewables from businesses by selling their energy to corporate energy buyers.

Why is buying solar power so appealing to businesses?

In a recent poll we conducted among our LinkedIn community, businesses said that, if they could choose where their renewable power came from, solar would be top of the list.

In addition, more and more commercial and public sector organisations are installing solar photovoltaic (PV) assets on-site. In fact, our latest Business Energy Tracker revealed an increase in the number of businesses considering investing in on-site generation, with solar PV being the most popular choice. Compared to when we conducted the research in 2022, there was a notable increase in the number of businesses that had already invested in solar PV, up to 36% in this year’s report from 27% last year.

It is not difficult to see why it is so popular. Businesses are less reliant on the grid, which means less exposure to volatile wholesale energy markets and the significant non wholesale energy costs that come with grid supply. And, when integrated with storage, solar can also provide a flexible power source available 24/7.

Additionally, businesses can meet their sustainability objectives and even sell any excess electricity back to the grid to raise additional revenue.

Taking this a step further, as mentioned, there is also the option for generators to sell this power to other companies who are eager to procure their energy supply from renewable sources.

How to sell your power to businesses

If you own or operate a solar asset, the best route to market to get your power businesses is usually via a power purchase agreement (PPA).

PPAs are contracts that agree energy production output and its subsequent purchase. They are made between asset holders who generate renewable power and commercial buyers. In short, they are a valuable route to market for generators to sell their power.

As an established method of managing energy sales and risk in generation projects, PPAs encompass all the commercial terms required to deliver a route to market for generation. They include start date, delivery schedules, pricing mechanisms, and payment terms and can include renewable certificates such as renewable obligation certificates (ROCs) and renewable energy guarantees of origin (REGOs). They are usually valid for several years and offer pre-set or to-be-determined prices for energy purchases.

A PPA can cover an existing generation asset or provide assurance and confidence to investors in the financing of new renewable projects. PPAs can therefore be agreed upon before a project becomes fully functional.

PPAs typically offer either fixed or variable pricing arrangements. When it comes to selling your power, deciding which PPA is best can be complex and is based on a range of factors, including:

- Annual output: fixed PPAs can be a good choice for generators with a limited annual output. However, if your annual output is 6GWh or more, flexible PPAs could offer a better route to market.

- The nature of your supply: while some renewables offer a steadier output, solar PV can be more intermittent and weather-dependent, so will usually suit a flexible PPA option.

- Your time constraints and risk appetite: the energy market is complex, and your familiarity with it can be a deciding factor when choosing the best PPA for your asset.

- Your business objectives: whether you want a steady and risk-free revenue stream or wish to optimise profits with a flexible agreement, your goals will ultimately determine which PPA is best for you.

Solar’s role in a secure and sustainable energy future

Embedding independent energy generation – including solar PV assets – into the UK’s wider energy infrastructure ultimately improves the reliability of our renewable energy supply and supports the growth of homegrown clean energy.

Generators can also help commercial and public sector organisations procure their power from renewable sources, helping them meet sustainability targets, reduce reliance on the grid and improve their overall resilience.