Image: Lightsource BP.

The UK has truly been in project development mode during 2020, with the start of the anticipated build onslaught now expected to start in 2021. This uptick in utility-based deployment will finally signal the transition of the UK market from a FiT/ROC subsidy-driven sector, to subsidy-free.

There are several aspects to this expected deployment surge from 2021, including what portion of sites may be successful in the next Contracts for Difference (CfD) round within which solar is now allowed to participate.

In addition, utility-scale ground-mount projects generally can be split into various groupings; mega-scale sites in excess of 50MWp-dc that require national or devolved planning approval, a deluge of 49.9MWp-dc sites across England, and smaller sites in the 1-10MW range by private landowners, local authorities and utility companies.

Recognising that each of these segments has a different route to market (both to get to shovel-ready status, and to move through the build process itself), Solar Power Portal will be hosting a special webinar on Tuesday 15 December 2020, featuring talks from Ronan Kilduff, managing director at Elgin Energy, Gareth Phillips, partner, energy & infrastructure at Pinsent Masons, and myself.

The contents of the webinar will provide coverage of the key themes above, in particular the challenges bringing mega-scale projects in the UK to fruition (major solar projects qualifying as Nationally Significant Infrastructure Projects, or NSIPs) and how the tried and tested process of selling packaged and shovel ready sites worth 100MW to 300MW in capacity will again be a key feature of the sector going into 2021.

The webinar is free to attend, with registration possible by completing sign-in details at the link here.

In this article, I will provide a year-end update to where utility-scale solar is in the UK, what has happened during 2020, and how understanding the business models of the key stakeholders behind the 13GW-plus of utility solar pipeline capacity in the UK will be key to success in the market over the next few years.

Scoping and screening new sites continues at fast pace

During 2020, I have been writing extensively about the sheer volume of new large-scale solar planning activity, across both new pre-application screened/scoped sites and with full planning applications, heavily weighted to 49.9MWp-dc occurrences.

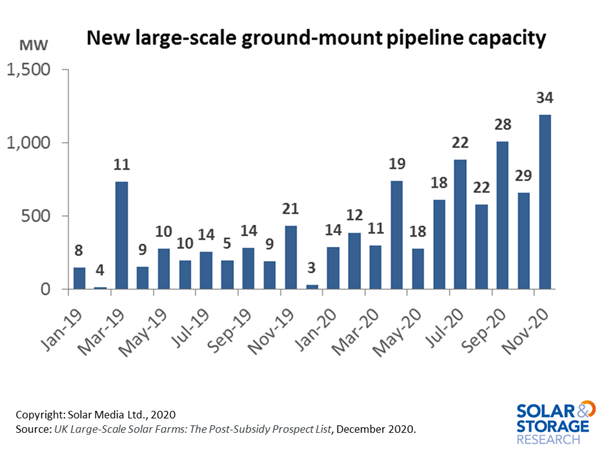

In fact, during November alone, 1.2GW of new UK solar farm capacity was added to the pipeline, a record amount in any single month. At the end of November, the UK pipeline had grown to 13.4GW. Incredibly, more than half of the 13.4GW capacity was added during the first 11 months of 2020. 2019 – the first real year of planning rebound – saw about 2.9GW of new sites captured.

Here is the latest graphic charting the growth of the UK utility-scale pipeline, right up to the end of November 2020, taken from the December 2020 release of the UK Large-Scale Solar Farms: The Post-Subsidy Prospect List report available on subscription through the link here.

Since April 2020, new site identification of large-scale solar farms in the UK has been operating at a blistering pace, with the past few months seeing 800-1200 MW per month added to the pipeline.

During 2019 and 2020, more than 10GW of new site capacity has been identified by planners in the UK – a massive amount by any standard. Of the current 13.4GW pipeline capacity, about 8.4GW (245 sites) is at pre-application stages (screening/scoping). The rest is in the planning system, with about 3.23GW having been approved (subject to conditions being discharged).

For those trying to understand how much of this may play in the forthcoming CfD round, we can quickly remove sites 10MW or below (as a nominal threshold). This leaves about 80 sites adding to 2.8-2.9GW. This in fact answers one of the most common questions I get today: how much solar capacity might enter the CfD round, assuming grid-connection and planning approval are the two main pre-requisites for entering the CfD round.

In fact, the number is higher than this. The auction may not happen for another 12 months. By this time, the figure will be somewhere closer to 5GW (as a rough indicator). But this is all for another day, once more information about the CfDs is forthcoming next year.

During the webinar on 15 December, I will go into more detail on the dynamics of the 13.4GW pre-build pipeline.

What type of developers are behind these sites? How many will take through to build-completion, thereby retaining decision-making on choice of EPCs, sub-contractors and component suppliers? Where are the sites located across the UK? How much of this 13.4GW is comprised of 49.9MWp-dc sites now?

Where is module pricing likely to go in 2021, and will all sites be using bifacial modules and tracking next year? How many of the sites are being identified by planners and UK partners that – despite being household names – actually have no experience at all in UK solar?

In fact, there are dozens of questions to ask right now, given the sheer scale of activity in pre-build phases, and a political climate in the UK that makes it easier to support renewables than resist them.

Combined with the insights from Elgin Energy and Pinsent Masons on the webinar, hopefully this will give listeners a good handle on what to expect from utility solar in the UK in 2021 and beyond. Remember to register now for the webinar, before we hit the maximum amount we can host at any single time! Follow the link here to register please.