The rush is well and truly on to secure business in the UK for ground-mounted solar farm deployment out to 31 March 2016. This was one of the conclusions from the recent Solar Energy UK event in Birmingham UK, last week.

Despite the government’s best efforts to stop UK solar, the industry continues to dig deep to make the best of the business opportunity confronting them.

Long-term energy supply issues aside, there are no prizes for being second on 1 April 2016, ahead of UK Solar part three.

We had lots of discussions with EPCs and module/inverter suppliers last week. Quick conclusions?

-

Lots of new EPCs from Southern and Eastern Europe getting brought in for 4.99MW work, either as Lead-EPC or pure sub-contracting.

-

Leading module suppliers sold out. Module supply opportunity now falling to less established brands.

-

Inverter supply getting more fragmented and competitive. While SMA remain the number one supplier by volume to the UK market (Power Electronics are second), the inverter market changed significantly about 12-18 months ago when the leading Chinese inverter suppliers made their move. Inverter supply is not considered to be a gating factor on deployment to 31 March 2016 for ground-mount. (Smaller plant size average helps here).

-

The vast majority of EPCs and component suppliers are not aware of the new customers available to them – more on this below.

The landscape for EPC and component supply for solar farms is different today. New EPCs and, in particular new developers/financiers, are now behind the pipeline of 5MW sites set for build-out to 31 March. A few years ago, the lucky recipients of Lightsource and Low Carbon build-outs were the winners. More recently, if you got into the package deals sold by Orta or Hive, business was good.

New days now: lots of new developers, or agents, in the mix. Some old names, but under the umbrella of different company names or vehicles. Net effect: more sites, lower average size from about 11MW in Q1’15 to expected average in the 5-6MW range in Q1’16 (higher due to 2014 grace build upside).

The Solar Intelligence research team is still frantically gathering all the projects, which effectively becomes the prospect list for EPCs and component suppliers over the next few months. And in so doing, we are having to go into every LPA (400 of them), and read off the information in all the applications, most importantly the date of submission. Government data providers don’t seem to be doing this, so they – again – cannot be aware of what is happening in the market now. Those reading off the REPD now are possibly getting the wrong conclusions.

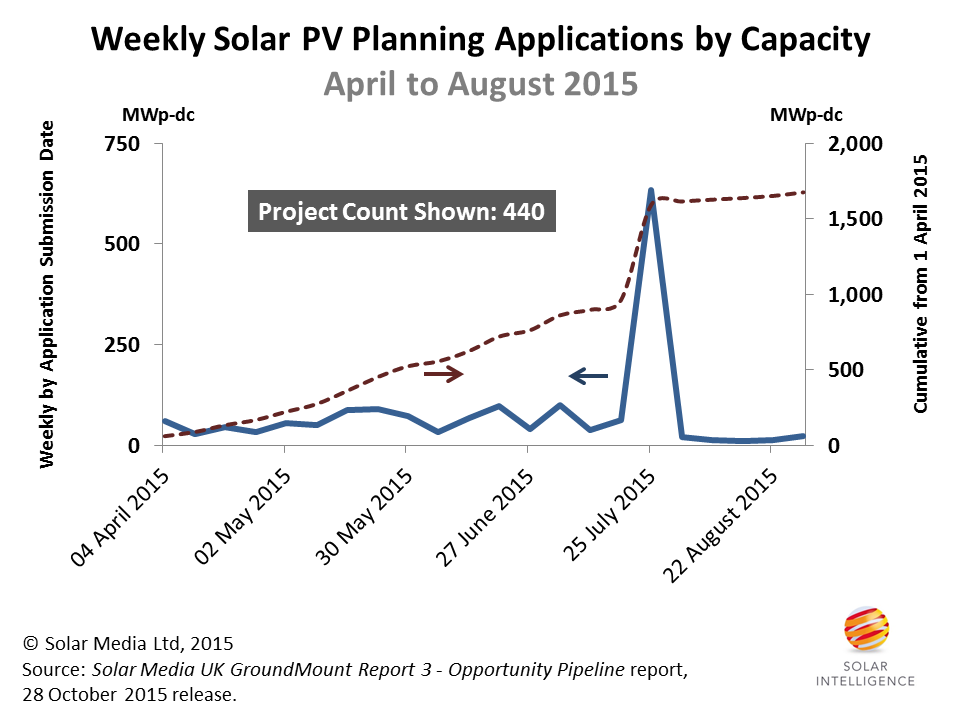

Here is our application submission stack of large-scale ground mount (RO, large-scale FiT >250kW, NIROC, CfD placeholders) solar applications to LPAs, from 1 April 2015. We put the cut-off date at end August 2015 for the graphic, as the lag in LPA validation these days is getting to chronic proportions, not helped by the fact that there are so many different LPAs getting solar farm proposals for the first time ever.

Figure Caption: UK solar farm applications for large-scale ground-mount sites (>250kW cut-off shown), between 1 April and 31 August 2015. Source: Solar Media Report 3 – Opportunity Pipeline, 28 October 2015 release issue.

All information on the 22 July submissions (together with the entire pipeline of solar farm projects in the UK) is detailed in our Report 3 – Opportunity Pipeline database report. What is most interesting from our database research is that we can draw a direct line between all the applications and a set group of developers. The trend is still to hide behind SPVs or assign the planner to lead the planning process, of almost no value to EPCs, component suppliers, or those looking to get first rights on buying sites for future asset additions. So mapping all the sites to the correct developer is essential.

The graph above shows a few interesting things:

-

Week of 22 July – almost all on that day alone – is now approaching 750MW of applications, with the final number only higher. (No surprises here if the 1GW mark is reached once all the validations show up from the LPAs, but will certainly be >750MW when fully collated.)

-

Five-month period from April to August accounted for 440 new database site entries, with more than 1.6GW of potential capacity. Final number likely to reach about 500.

-

The total project listing, in the latest Report 3 – Opportunity Pipeline database, is close to 1,000 now. About half of these projects fall into ‘strong-prospects’, based on our internal research criteria; the other half likely to fall out for a bunch of attrition-based reasons.

-

A select group of developers are continuing to put in large-scale applications post 22 July. Most likely reason for this is FiTs, something that the government is potentially encouraging through its delays in the FiT policy change process. More on this from us, after DECC concludes its findings. Legislation in Northern Ireland and Scotland also presents some options compared to England/Wales.

With more projects, more uncertainty, more developers in the mix, and just a few months to close business, seven-day weeks for many in the UK industry have started and will continue for the next four months.

Either way, there are few excuses for EPCs, or module/inverter/component suppliers, serving the UK market in not being sold out to 1 April 2016. Indeed, it is likely there are companies that are not serving the UK ground-mount sector today that could be getting eleventh-hour phone calls in January and February 2016.

As for rooftops and standalone FiTs (the industry’s favourite ROO-FiT process), there is an altogether different set of factors at play now; more on that one also from us soon also. For those guys though, seven days in a week are simply not enough right now, and just to make it even worse, they don’t know what day the cliff-edge will hit them yet.