You don’t need to be a rocket scientist to know that the UK solar market has slowed down right now. The summer months have always been slow after 31 March ROC surges, and as developers and asset holders re-assess what is on the table for the next 12 months. The difference of course this year is that this is the final year for ROCs (to 31 March 2017). There was a hard-stop on planning applications back on 22 July 2015, and we have now the thorny issue of the Brexit referendum result.

All said and done, this is the final year of ROCs for the UK solar industry, and ROCs have been the main reason the UK has installed 12GW of solar. Furthermore, we know also that project developers are extremely creative at making things happen, despite alarm bells being sounded that would indicate the game is over.

It is worth remembering these phrases from the past: the UK market will die if ROCs are cut from 2.0 to 1.6; switchgear product is on 26 week lead-time; no-one will be able to build out 5+5MW sites due to the effort involved; sites are uneconomical at 5MW; there is no spare grid capacity in Northern Ireland; grid-connection is making the sites unviable. The list goes on.

The UK installed over 2.5GW in Q1 2015 and then more than 1.5GW in Q1 2016.

What does the 1.2ROC pot look like now?

The pipeline of UK solar farms has been depleted since 23 July 2015, having bloated to well over 10GW as the GW-level of applications was submitted by midnight on 22 July last year.

Today, the pipeline stands at less than 4GW, with site completions (under 1.3ROC and pre-accredited FiTs) in the past few quarters having brought down the pipeline significantly. Adding to this fall to below 4GW has been the various sites rejected from 22 July application or withdrawn by the developers due to a range of reasons, but mainly on the assumption of not meeting the validity qualifications for ROC grandfathering.

The interesting thing in the past few weeks has been hearing from a number of mainland Europe EPCs that would appear to have reacted in a remarkably knee-jerk manner post-Brexit referendum. If there is one thing to note from UK solar, it should be to not throw in the towel before 31 March. One wonders ultimately if many of these EPCs will wake up on 1 April 2017, cursing their decision to call time on the UK with only eight months left of the RO scheme.

If anything, now is a time to be extremely clever in working out which of the 500-plus solar farms (still left in the pipeline and included in our monthly report database) are worth pursuing. Knowing the answer to this has never been more challenging, meaning those putting in the extra effort for due diligence on sites (either from a site acquisition or EPC perspective) will be the ones that manage to add capacity out to 31 March next year.

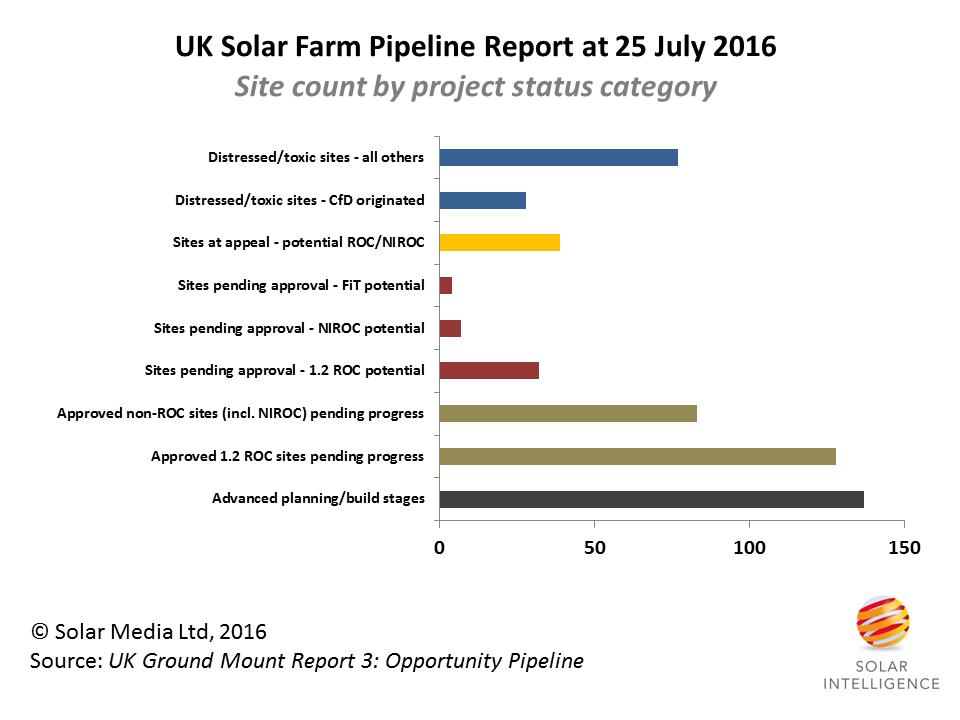

To assist this site selection process, we are now forecasting the project pipeline with an even greater degree of filtering. This is shown through the two graphics below.

There are more than 500 solar farm sites still in the UK, included in our project pipeline monthly report database. The viability of these varies significantly, with about one-third being nothing more than legacy placeholders and having no source of incentives.

The above graphic breaks out the 500-plus sites into a range of risk-based categories, analogous to a sales prospect list, with the least likely shown in bars at the top of the above graphic, to those at the bottom that have a very high chance of being completed between today and 31 March 2017.

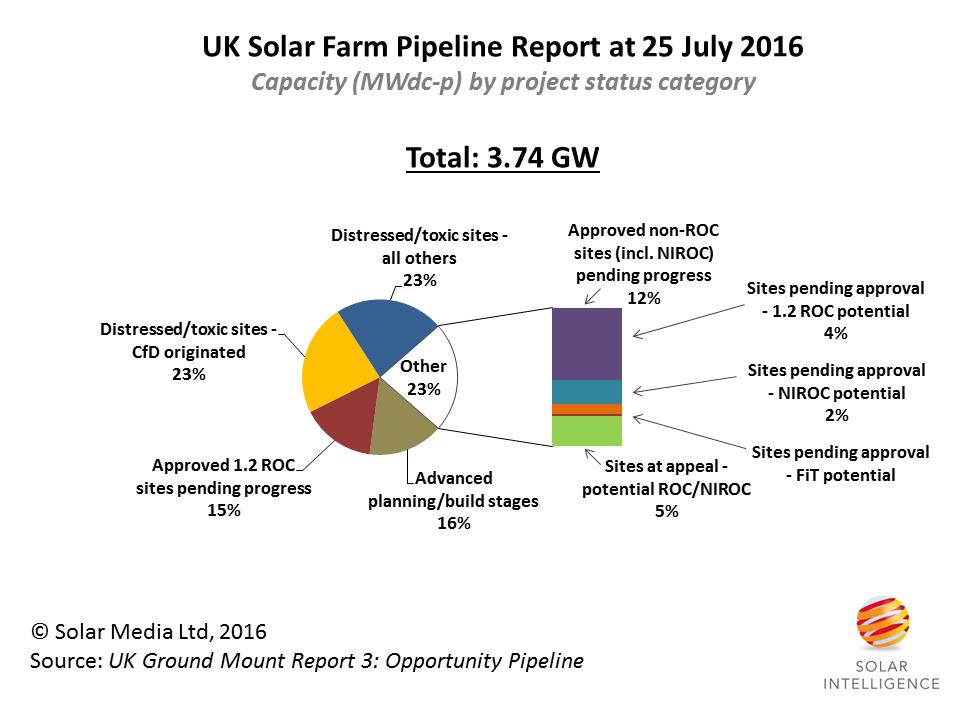

If we look at the same information by site capacity, we have this pie chart representation:

The 3.74GW of solar farms left in the pipeline reveals that about 1.5GW are potential opportunities before 31 March 2017, of which the actual capacity completed is likely to be about 30% of this sub-total.

Industry expects 500-600MW of 1.2ROC projects likely to be completed

While we continue to do our detailed forecasting, bottom-up at the site level and using all the data from our report database, it is also interesting to get feedback from developers, EPCs and component suppliers (especially modules and inverters).

In this respect, there is a massive divide in opinions, with those that have already decided to retreat from the market voicing negativity in droves: in contrast, those actually working the sites and finance models are looking at an additional market build capacity between now and 31 March 2017 at the 500-600MW level. Comparing to the categories above, this would not seem at all crazy.

All this brings to mind how having good local knowledge is a must. Some years ago in the days of 1.6ROCs, Norwegian based global solar energy powerhouse Scatec Solar partnered with local developer Green Energy UK Direct to kick-start capacity contributions from the burgeoning UK solar market. However, the success of their chosen partner was not good, and Scatec Solar retreated from the UK very quickly, citing at the time negative government policy changes. The UK then went on to add more than 6GW of solar farm capacity! Let this be a lesson to others with just 8 months left to run under the RO scheme.

What to do now, to benefit from the final months of ROCs

Currently, knowing the sites left, the status of them, who owns the SPVs, and the chances of them coming to fruition before 31 March next year, is paramount.

This Thursday, 11am on 28 July 2016, we are hosting a free webinar where we will discuss the issues relating to the site categories shown in the graphics above. Details on how to register for the webinar can be found here.

Our UK project database is also a key resource to have, to get the site information and track changes in the market as they happen out to 31 March 2017. Details on subscribing can be found here.

Also on the Thursday webinar, we will also be introducing the emerging multi-GW pipeline of solar farms now taking shape in the Republic of Ireland. The timing here is excellent for companies having benefited from the UK in the past few years, with the UK downturn in 2017 overlapping with the expected kick-off of solar farm builds in Ireland.

You can also subscribe to our forthcoming Republic of Ireland Solar PV Opportunity Tracker Report, with a special discount offer until the end of August 2016.

Lastly, two key events to bookmark: Solar Energy UK, Clean Energy Live at the NEC in Birmingham on 4-6 October 2016 to get all the final deals for EPC and component supply under 1.2ROCs, and Solar PV Ireland in Dublin on 15-17 November 2016 to meet with all the key stakeholders set to drive the market in Ireland out to 2020.