Global finance giant Legal & General (L&G) is backing rooftop PV with £57.5 million of long-term debt financing.

The financing is being provided to Hermes Infrastructure for the recapitalisation of its two PV portfolios in England and Wales.

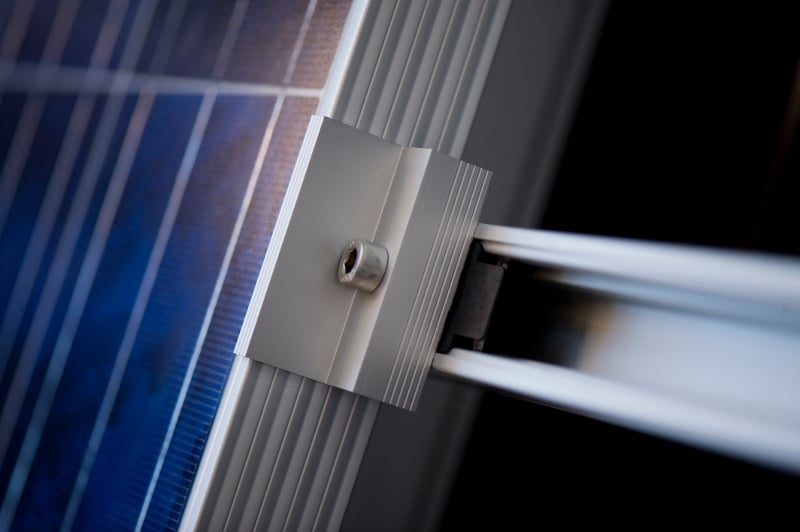

The portfolios – with a combined install capacity of 34.52MWp – stretch across 9,000 residential homes, the majority of which are on private residences and c10% on social housing rooftops.

The portfolios are accredited under the feed-in tariff scheme, providing a high level of cash flow visibility until maturity in 2033 and 2036.

The investment was made by L&G's division LGIM Real Assets, on behalf of its clients, which includes Legal & General Retirement Institutional.

Tom Sumpster, head of infrastructure finance at LGIM Real Assets, said: “With the cost of power from wind and solar continuing to fall, consumer demand for clean power is increasing.

“Further investment in sustainable energy benefits society and provides secure investments to match our pension liabilities and payments.”

L&G has a long-standing relationship with solar, having most recently appointed HBS New Energies to deliver solar as part of its sustainable housing development. The firm also provided £48 million of senior financing in 2018 to support Fiera Infrastructure in the acquisition of a 41MWp portfolio.