Recently, the UK solar industry was awarded 4.5GWp-dc, across 93 sites, in allocation round 6 (AR6) of the Contracts for Difference (CfD) scheme, the highest capacity seen since the CfD scheme was started back in 2014.

The CfD scheme has been particularly beneficial to the industry. Solar projects were originally allowed to compete in the first CfD auction (AR1). However, solar was then omitted in the subsequent AR2 and AR3 auctions. Solar returned to the allocation rounds in 2022 for AR4, when sites adding up to 3.1GWp were successful, followed by 2.7GWp in the AR5 auction process in 2023.

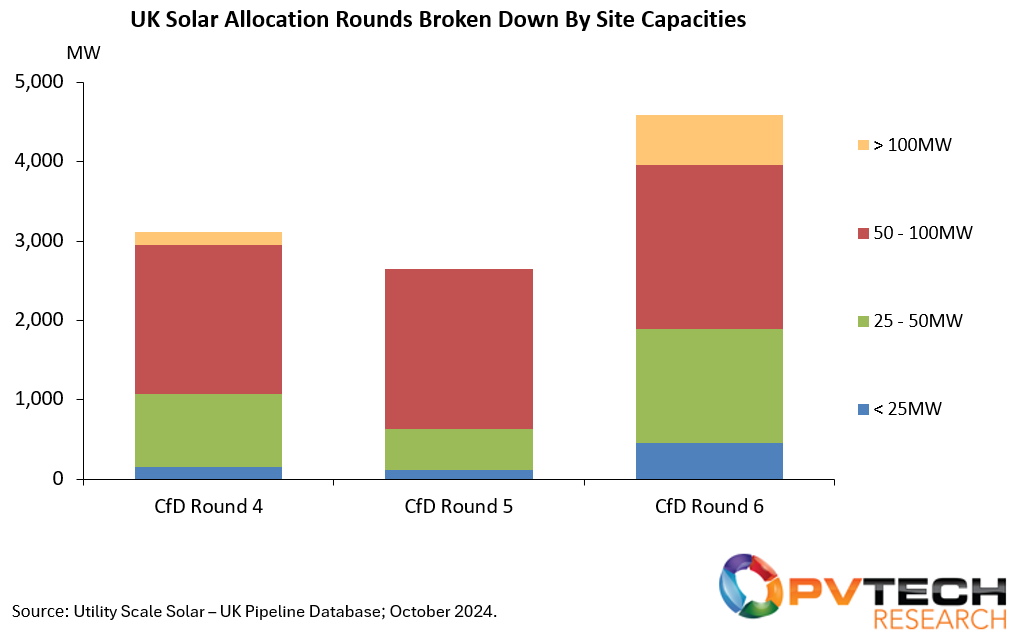

Taking a closer look into the results from the three most recent auctions, we can see from Figure 1 below that sites rated in the 50-100MWp category account for most of the capacity, with 60% in round 4 and 75% in round 5.

The main difference in the most recent allocation round for solar can be seen in the 25-50MWp range, which received almost three times the capacity, compared to round 5.

Another striking difference in AR6 is in the >100 MWp range; in round 4, Cleve Hill won 150MWp, just under half of this site’s total capacity approved. Round 6 saw two separate sites, each greater than 100MWp, win contracts; Longfield and Little Crow recieving 420MWp and 140MWp, respectively.

Figure 1: Breakdown of capacities for different site size categories winning CfDs in AR4, AR5 and AR6 (the most recent auction).

Using details from the full site-specific audit trails, contained within the Utility Scale Solar – UK Pipeline Database, we can investigate individual sites in far more detail than seen from the basic results published in the CfD table of awards that was disseminated in the public domain.

The starting point is to identify all the sites that received funding. Due to nearly all the applicants using the sites’ special purpose vehicles (SPVs) for naming purposes, there is an immediate requirement to match all the sites with the actual developer/site-owners. This task was relatively simple to undertake, as SPVs form a core part of the site-specific audit trail methodology we have been undertaking on UK solar farms since the UK sector started in 2010.

Two of the sites have already been completed, totaling 45 MWp, most notably the Horsey Levels solar farm earlier this year.

There are currently nine sites under construction, with a combined capacity of 400MWp, with a further two sites close to completion.

When looking at the 84 sites that are approved but not yet under construction or completed, there are over 30 projects discharging their planning conditions. Many other sites have signed contracts with EPCs, or have in-house EPC operations set to be involved during the build process.

Looking at the developers (or site owners), 47 different developers were involved in the contracts awarded; significantly more than in the past with 17 successful in AR4 and 22 in AR5.

Nineteen of these 47 developers previously received a CfD in earlier rounds, implying that 28 new developers/owners won contracts in the recent AR6.

Current status of sites awarded contracts in AR5 and AR6

Projects awarded in AR4 have been progressing smoothly, with over 700MWp completed and a further 950 MWp currently under construction.

It is likely 2025 will be another positive year; round 5 sites awarded account for 850MWp of capacity that is currently under construction, just under a third of the capacity won in the previous round.

Figure 2: Build status of solar sites awarded contracts in the most recent CfD allocation rounds.

Figure 2 highlights the build-out lag from the previous rounds, with over half of the capacity awarded in AR4 starting construction within two years. AR5 is following a similar trend when looking at the results announced just over a year ago; about one third of the overall capacity allocated in AR5 is currently under construction, with a further 750MWp at, or getting close to, the ready-to-build stage.

Overall, it is clear that the recent CfD rounds have had a dramatic impact on the UK solar sector. Not only are established developers continuing to benefit from the scheme, but new stakeholders are also participating inthe allocation rounds.

With AR6 seeing a record level of capacity for UK solar, this will certainly play a key part in the new UK government’s desire to prioritize solar as a technology, something that had been sorely missing in the previous government’s rhetoric when it came to the breakdown of new energy sources needed to replace fossil fuel sites.

To access the full audit trails and status of all 93 sites awarded contracts in the recent AR6 auction, please follow the instructions here.