Power market analysts LevelTen Energy has published its latest report on the European renewable power purchase agreement (PPA) sectors, noting a slight increase for those signed in the UK compared to Europe.

The UK saw PPA prices increase by 1% in its P25 solar price, which LevelTen attributed to the UK government increasing the administrative strike price for solar in the latest Contracts for Difference round by 30% from £47/MWh to £61/MWh.

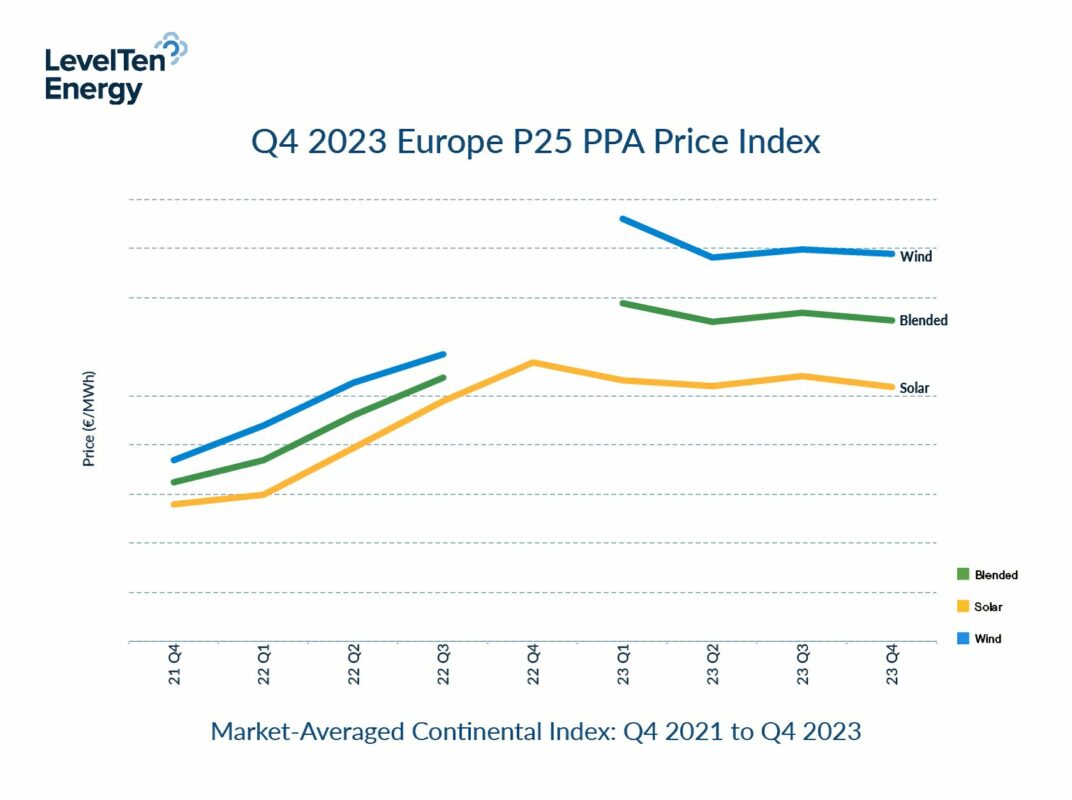

In contrast, Europe saw the average price of a solar PPA decline slightly, falling 3% between the third and fourth quarters of 2023 to €71.84 (£61.33)/MWh. This is the latest quarter in which the European solar PPA price has fallen, since peaking at €76.84 (£65.59)/MWh in the final quarter of 2022, and the relative stability of European PPA prices, with this figure falling by exactly €5 (£4.27) from one year to the next, could be of benefit to investors and developers alike, as the market is becoming more stable.

The report’s authors also noted that the phenomenon of price cannibalisation is becoming more present in a number of European markets, such as Spain, a topic that was discussed at Solar Media’s Solar Finance & Investment Europe event last week.

While some of the impacts of this have been negated somewhat by a decline in the price of solar module manufacturing, the vast majority of manufacturing capacity remains in China, and actors in the European solar sector are increasingly concerned that this state of affairs will create a damagingly imbalanced solar supply chain, raising questions about the financial viability of European solar as a whole.

Analysts at LevelTen, however, retain some optimism for the economics of the European solar sector, with Plácido Ostos, director of European energy analytics at the company, calling the sustained decline in PPA prices “encouraging”.

“There is also growing optimism that high interest rates from the European Central Bank have reached their peak and are poised to begin coming down,” added Ostos. “A high-rate environment places significant pressure on project revenue to meet developers’ financing needs — revenue that often must be, at least partly, sourced from project offtakers via higher PPA prices.

“If and when rates begin to drop, it should release some of this upward price pressure, though those impacts will take time to materialise,” Ostos added.

This is an extract from an article published on out sister site PV Tech. The orignal can be read here.